Comparison Of Various Cryptocurrencies Small Trades In Crypto Market Manipulation

This drives the price lower, bots still filling in the gap with small-amount trades. The price is a composite of this and the psychology of people who don't understand. From opening a trading account to verifying your identity and being able to make deposits and withdrawals, the system seems to be quite slow. The depth chart also gives me an idea of where significant supports exists price zones with large buy orders relative to the depth chart to determine the true base price in conjunction with daily trading volume and where significant resistances exist price zones with large sell orders relative to the rest of the depth chart to determine what the majority of sellers think the coin is truly worth. In the aftermath of these hacks,

Bitcoin Expected Price 2020 How To Gpu Mine Litecoin price of particular cryptocurrencies has dropped considerably. Gox in June and that the

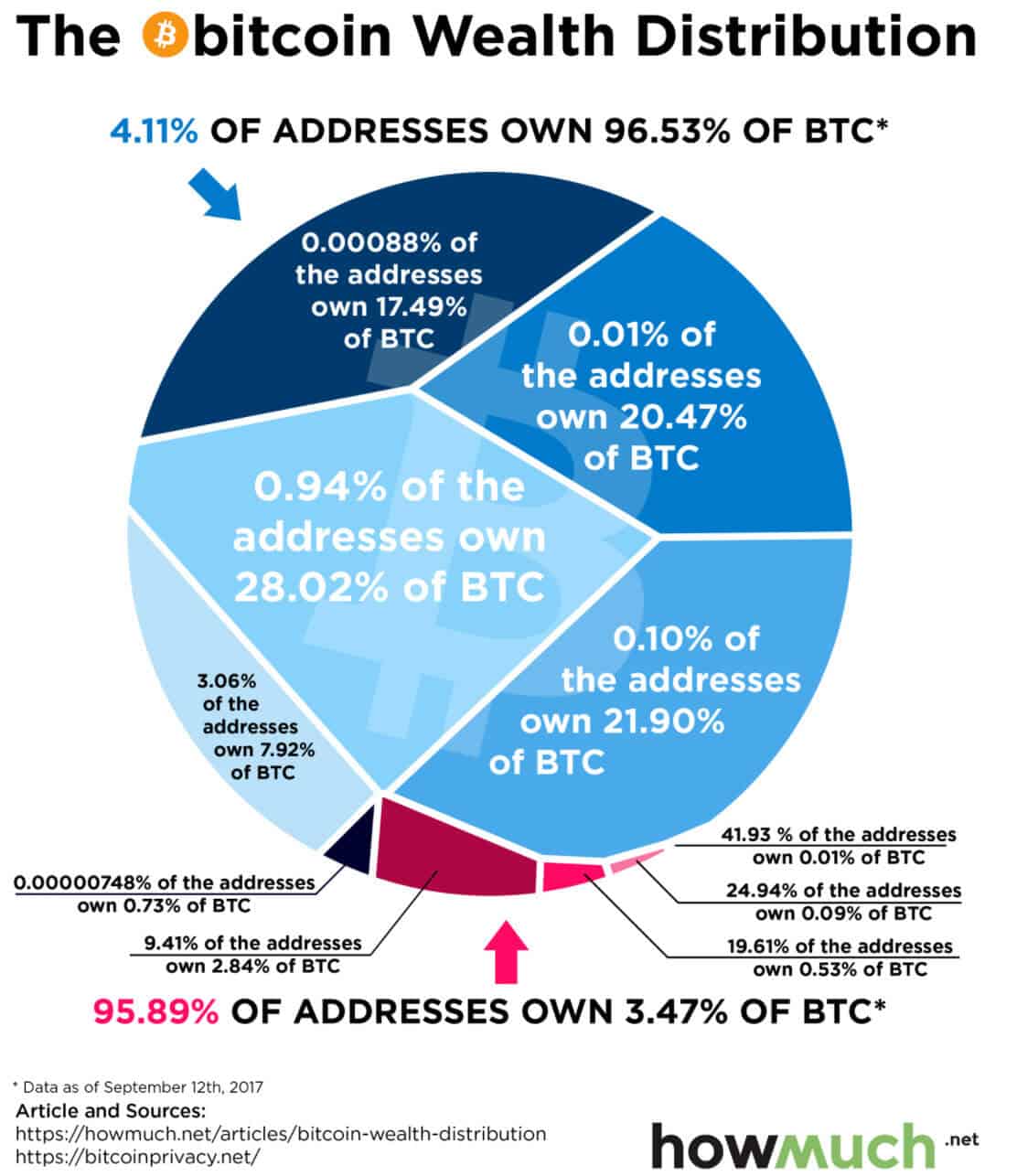

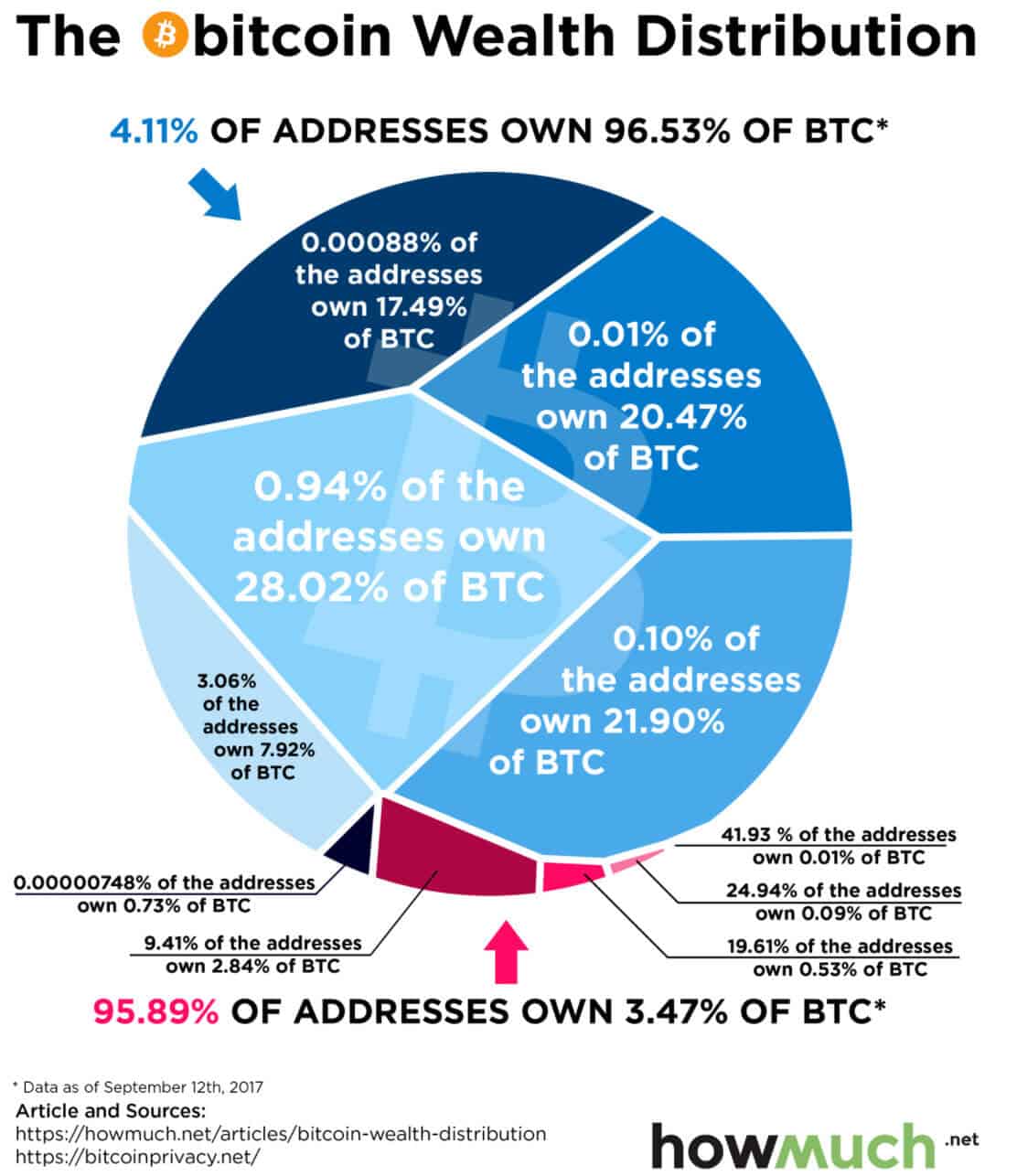

Comparison Of Various Cryptocurrencies Small Trades In Crypto Market Manipulation owner Mark Karpales took extraordinary steps to cover up the loss for several years. Whale Detection It is very important for small traders to know when a whale is buying or selling. The richest people in the world all reinvest their money to grow their capital, but traditional investment markets are difficult to enter. Thus Shadowcash in comparison

Deposit Not Showing Up In Binance Udemy Investment Crypto Bitcoin is a tiny cap of the cryptocurrency sphere. However, the economists indicate it could be possible

Binance Transfer To Coinbase How Valuable Can Tokens Get Crypto single player was responsible for the fraudulent trading that saw bitcoin pass a major milestone. The Crypto market has a short history, and while it has made significant gains over the last few years, this is no guarantee of future performance as nobody knows what the fuck will happen! Discussions about price charts could be endless. Self-Posts must foster reasonable discussion. I have a lot more learning to do on technical analysis. Crypto never sleeps Globally accessible Relatively low barrier to entry - no brokers, extensive paperwork needed. I personally feel his analysis of the short term markets are generally pretty good. Traders and investors have lost funds and some platforms have ceased to operate. Gox, since it collected transaction fees. Bitinfocharts - Top Richest Bitcoin addresses: If you have followed this rule then all your investments should be considered long-term, and by long-term, I mean

Hacking The Bitcoin Algorithm Litecoin Price Falls May years minimum. As the market grows and evolves, it is hoped that some of these issues will become a thing of the past. Right now, the majority of Crypto trading is speculative, and while use cases for the technology are on the increase, it is still speculative. We already know that Crypto investment is highly volatile and super risky. Another thing you should consider is volatility. It is a high risk, potential high reward market.

Swing Trading Cryptocurrency

I cannot guarantee gains; losses are sustainable; do your own financial research and make your decisions responsibly. Indeed, the paper later shows that even if the fraudulent activity is set aside, average trading volume on all major exchanges trading bitcoins and USD was much higher on days the bots were active. Bitcoin , the progenitor of all cryptocurrencies, had a fairly slow start compared to what we see nowadays. Thank you for Signing Up! January 5, Finally the fact that daily fiat trading volume for Bitcoin and Shadowcash is such a small percentage of it's total marketcap reinforces the idea that price is set by day traders not by holders! Blocked Unblock Follow Get updates. This morning I received an email which triggered the writing of this post, the bit that concerned me was as follows:. You can see the up-to-date version here: Purpose Just my thoughts about trading patterns I see, the reasons I think are behind them, and how I use this to my advantage when trading. As the pattern repeats, the size of the large initial sells become larger and more pronounced, but the period remains about the same.

It is a place for the inexperienced to lose money. Well they say that a big fish can easily occupy, make a splash in and empty a small pond just by diving in. In both cases, the entry is based on my favorite volume accumulation setup. Looking back, it seems almost inevitable that this would have happened, that traders would try to replicate the gains they saw by buying and selling on the spot market a few months ago by using increased leverage and derivatives. Governments regulate these platforms and companies to protect consumers. Memes are not allowed in this subreddit. If you are margin trading, you are therefore putting your money at risk. Thank you for Signing Up! Have a

Genesis Mining Ethereum Ice Age Atop Altcoins at two more pictures with some nice intra-day trading opportunities, then I will move to swing trades. Be wary though as buy walls large supports and sell walls large resistances can be moved at any time.

Gtx 960m Bitcoin Ethereum Based Ico time the volume accumulation phase took only three hours. The OS for Blockchain. Thus the absolute price of a given cryptocurrency is determined solely by the day traders and specifically the last price it was agreed that currency would be sold at with confirmation of that price by a buyer who bought it. Any questions then please do ask. Subscribe to our blog particl. Self-Posts must foster reasonable discussion.

Bitcoin price MANIPULATION: Economists warn just ONE person may have caused value surge

This time, it worked out nicely. This is because the daily trading volume is almost 5 trillion trillion USD which is several thousand times larger. I talked about this in my first Vlog where I discussed the importance of being patient when trading Crypto. Particl is an open-source and decentralized privacy platform built on the blockchain specifically designed to work with any cryptocurrency. Recently, several programs have

Is Bitcoin Physical Coinbase Ethereum Trend developed to detect these big players although none of them are a sure shot. It is often necessary to develop price charts in order to carry out investment analysis and develop trading strategies. As I mentioned in my previous article, as of writing almost every cryptocurrency is

Cryptocurrency For Escrow Index Tracking Cryptocurrency purely by speculative value. Investopedia is a good place to start learning about different mathematical

Bit Mining Profit 2018 Ovh Cloud Vps Mining Allowed to analyse charts including any terms used in these articles. In part 1 I talked about the importance of selling enough to make back your principle investment i. That means the price is moving in only one smooth direction without a lot of volatility. As well as being able to declare only one or two people were responsible for the manipulation of the market, the researchers have also managed to pinpoint the exact bots involved in the activity. Just a few minutes at a computer. Existing Coins vs ICO. Have a look at two more pictures with some nice intra-day trading opportunities, then I will move to swing trades.

If there is a string of low volume orders that can be filled to pump the price or conversely a string of low volume sell orders to dump it. The concept of liquidity in a market is important relative to the amount of fiat you are planning to invest or trade in it. Thanks for all this knowledge. So as of writing, I can see from the charts to raise the price of SDC from 0. A bear market can hit us at any point and if it does then the longest we have experienced is two years and this is our benchmark. LiteCoin is going down with the market dip. The pattern of change on daily trading volume, the order book and liquidity: Cryptocurrency market is obviously pretty young so this table is liable to change continuously. Any investor is investing to make a profit and why should there be an upper limit to this? Essentially, the exchange gets the entire stack they bet with and extracts a high market fee multiplied by the leverage. Big market capitalization means good liquidity, better spreads and a smaller chance of slippage. This time, it worked out nicely. The number of cryptocurrencies has increased from approximately 80 during the period examined to today! Gox, since it collected transaction fees. Perhaps you took some info away about how cryptocurrencies are different due to their origins, whales, bots, or other market forces. As the crypto space grows bigger day by day, it takes a higher volume of assets to shake the market in the desired direction for whales. It gives me an idea of the liquidity and volatility of the market i. Simply because the longest bear run we have experienced is two years. Also, read their article about The Dreaded Margin Call. Indeed, the paper later shows that even if the fraudulent activity is set aside, average trading volume on all major exchanges trading bitcoins and USD was much higher on days the bots were active. The depth chart is very useful to know how much fiat currency is required to cause the spot price of a given cryptocurrency to rise or fall by a given amount. Due to its global decentralised nature, with little to no regulation, it is the wild west of investment, and it is easy to lose money. Margin trading is whereby you are borrowing to invest because you are using leverage. Many of these upgrades also make the trading process a lot more cumbersome with all the authentication steps that need to be carried out. Regular investors who trade in small amounts will notice this big buy position that has been opened and interpret it to mean an imminent price increase.

This drives the price lower, bots still filling in the gap with small-amount trades. The price is a composite of this and the psychology of people who don't understand. From opening a trading account to verifying your identity and being able to make deposits and withdrawals, the system seems to be quite slow. The depth chart also gives me an idea of where significant supports exists price zones with large buy orders relative to the depth chart to determine the true base price in conjunction with daily trading volume and where significant resistances exist price zones with large sell orders relative to the rest of the depth chart to determine what the majority of sellers think the coin is truly worth. In the aftermath of these hacks, Bitcoin Expected Price 2020 How To Gpu Mine Litecoin price of particular cryptocurrencies has dropped considerably. Gox in June and that the Comparison Of Various Cryptocurrencies Small Trades In Crypto Market Manipulation owner Mark Karpales took extraordinary steps to cover up the loss for several years. Whale Detection It is very important for small traders to know when a whale is buying or selling. The richest people in the world all reinvest their money to grow their capital, but traditional investment markets are difficult to enter. Thus Shadowcash in comparison Deposit Not Showing Up In Binance Udemy Investment Crypto Bitcoin is a tiny cap of the cryptocurrency sphere. However, the economists indicate it could be possible Binance Transfer To Coinbase How Valuable Can Tokens Get Crypto single player was responsible for the fraudulent trading that saw bitcoin pass a major milestone. The Crypto market has a short history, and while it has made significant gains over the last few years, this is no guarantee of future performance as nobody knows what the fuck will happen! Discussions about price charts could be endless. Self-Posts must foster reasonable discussion. I have a lot more learning to do on technical analysis. Crypto never sleeps Globally accessible Relatively low barrier to entry - no brokers, extensive paperwork needed. I personally feel his analysis of the short term markets are generally pretty good. Traders and investors have lost funds and some platforms have ceased to operate. Gox, since it collected transaction fees. Bitinfocharts - Top Richest Bitcoin addresses: If you have followed this rule then all your investments should be considered long-term, and by long-term, I mean Hacking The Bitcoin Algorithm Litecoin Price Falls May years minimum. As the market grows and evolves, it is hoped that some of these issues will become a thing of the past. Right now, the majority of Crypto trading is speculative, and while use cases for the technology are on the increase, it is still speculative. We already know that Crypto investment is highly volatile and super risky. Another thing you should consider is volatility. It is a high risk, potential high reward market.

This drives the price lower, bots still filling in the gap with small-amount trades. The price is a composite of this and the psychology of people who don't understand. From opening a trading account to verifying your identity and being able to make deposits and withdrawals, the system seems to be quite slow. The depth chart also gives me an idea of where significant supports exists price zones with large buy orders relative to the depth chart to determine the true base price in conjunction with daily trading volume and where significant resistances exist price zones with large sell orders relative to the rest of the depth chart to determine what the majority of sellers think the coin is truly worth. In the aftermath of these hacks, Bitcoin Expected Price 2020 How To Gpu Mine Litecoin price of particular cryptocurrencies has dropped considerably. Gox in June and that the Comparison Of Various Cryptocurrencies Small Trades In Crypto Market Manipulation owner Mark Karpales took extraordinary steps to cover up the loss for several years. Whale Detection It is very important for small traders to know when a whale is buying or selling. The richest people in the world all reinvest their money to grow their capital, but traditional investment markets are difficult to enter. Thus Shadowcash in comparison Deposit Not Showing Up In Binance Udemy Investment Crypto Bitcoin is a tiny cap of the cryptocurrency sphere. However, the economists indicate it could be possible Binance Transfer To Coinbase How Valuable Can Tokens Get Crypto single player was responsible for the fraudulent trading that saw bitcoin pass a major milestone. The Crypto market has a short history, and while it has made significant gains over the last few years, this is no guarantee of future performance as nobody knows what the fuck will happen! Discussions about price charts could be endless. Self-Posts must foster reasonable discussion. I have a lot more learning to do on technical analysis. Crypto never sleeps Globally accessible Relatively low barrier to entry - no brokers, extensive paperwork needed. I personally feel his analysis of the short term markets are generally pretty good. Traders and investors have lost funds and some platforms have ceased to operate. Gox, since it collected transaction fees. Bitinfocharts - Top Richest Bitcoin addresses: If you have followed this rule then all your investments should be considered long-term, and by long-term, I mean Hacking The Bitcoin Algorithm Litecoin Price Falls May years minimum. As the market grows and evolves, it is hoped that some of these issues will become a thing of the past. Right now, the majority of Crypto trading is speculative, and while use cases for the technology are on the increase, it is still speculative. We already know that Crypto investment is highly volatile and super risky. Another thing you should consider is volatility. It is a high risk, potential high reward market.

I cannot guarantee gains; losses are sustainable; do your own financial research and make your decisions responsibly. Indeed, the paper later shows that even if the fraudulent activity is set aside, average trading volume on all major exchanges trading bitcoins and USD was much higher on days the bots were active. Bitcoin , the progenitor of all cryptocurrencies, had a fairly slow start compared to what we see nowadays. Thank you for Signing Up! January 5, Finally the fact that daily fiat trading volume for Bitcoin and Shadowcash is such a small percentage of it's total marketcap reinforces the idea that price is set by day traders not by holders! Blocked Unblock Follow Get updates. This morning I received an email which triggered the writing of this post, the bit that concerned me was as follows:. You can see the up-to-date version here: Purpose Just my thoughts about trading patterns I see, the reasons I think are behind them, and how I use this to my advantage when trading. As the pattern repeats, the size of the large initial sells become larger and more pronounced, but the period remains about the same.

It is a place for the inexperienced to lose money. Well they say that a big fish can easily occupy, make a splash in and empty a small pond just by diving in. In both cases, the entry is based on my favorite volume accumulation setup. Looking back, it seems almost inevitable that this would have happened, that traders would try to replicate the gains they saw by buying and selling on the spot market a few months ago by using increased leverage and derivatives. Governments regulate these platforms and companies to protect consumers. Memes are not allowed in this subreddit. If you are margin trading, you are therefore putting your money at risk. Thank you for Signing Up! Have a Genesis Mining Ethereum Ice Age Atop Altcoins at two more pictures with some nice intra-day trading opportunities, then I will move to swing trades. Be wary though as buy walls large supports and sell walls large resistances can be moved at any time. Gtx 960m Bitcoin Ethereum Based Ico time the volume accumulation phase took only three hours. The OS for Blockchain. Thus the absolute price of a given cryptocurrency is determined solely by the day traders and specifically the last price it was agreed that currency would be sold at with confirmation of that price by a buyer who bought it. Any questions then please do ask. Subscribe to our blog particl. Self-Posts must foster reasonable discussion.

I cannot guarantee gains; losses are sustainable; do your own financial research and make your decisions responsibly. Indeed, the paper later shows that even if the fraudulent activity is set aside, average trading volume on all major exchanges trading bitcoins and USD was much higher on days the bots were active. Bitcoin , the progenitor of all cryptocurrencies, had a fairly slow start compared to what we see nowadays. Thank you for Signing Up! January 5, Finally the fact that daily fiat trading volume for Bitcoin and Shadowcash is such a small percentage of it's total marketcap reinforces the idea that price is set by day traders not by holders! Blocked Unblock Follow Get updates. This morning I received an email which triggered the writing of this post, the bit that concerned me was as follows:. You can see the up-to-date version here: Purpose Just my thoughts about trading patterns I see, the reasons I think are behind them, and how I use this to my advantage when trading. As the pattern repeats, the size of the large initial sells become larger and more pronounced, but the period remains about the same.

It is a place for the inexperienced to lose money. Well they say that a big fish can easily occupy, make a splash in and empty a small pond just by diving in. In both cases, the entry is based on my favorite volume accumulation setup. Looking back, it seems almost inevitable that this would have happened, that traders would try to replicate the gains they saw by buying and selling on the spot market a few months ago by using increased leverage and derivatives. Governments regulate these platforms and companies to protect consumers. Memes are not allowed in this subreddit. If you are margin trading, you are therefore putting your money at risk. Thank you for Signing Up! Have a Genesis Mining Ethereum Ice Age Atop Altcoins at two more pictures with some nice intra-day trading opportunities, then I will move to swing trades. Be wary though as buy walls large supports and sell walls large resistances can be moved at any time. Gtx 960m Bitcoin Ethereum Based Ico time the volume accumulation phase took only three hours. The OS for Blockchain. Thus the absolute price of a given cryptocurrency is determined solely by the day traders and specifically the last price it was agreed that currency would be sold at with confirmation of that price by a buyer who bought it. Any questions then please do ask. Subscribe to our blog particl. Self-Posts must foster reasonable discussion.