How To File My Taxes With Bitcoin Best Litecoin Wallet App

It was not easy and it took a significant amount of time.

Digital Economy Bitcoin Difference Between Ethereum And Bitcoin about it here: It is said that that litecoin is not like a stock or bond. It seems there has been a lot of hype lately in the currencies. I am not a tax or accountant professional so take the following with a grain of salt They are, however, easier to lose. How Do I Use Ethereum? What Can You Buy with Bitcoin? Best of all - it's free! If your computer gets stolen or corrupted and your private keys are not also stored elsewhere, you lose your bitcoin. I know I won't change your mind and I'm not going to respond. It may have been my browser, but the file definitely downloaded without an extension which stumped me for about an hour. If you are part of a pool, which almost everyone is, this is really impossible to. What you just described would cause you to pay more tax if you

How To File My Taxes With Bitcoin Best Litecoin Wallet App called out by the IRS. If you're playing at that level or higher, expect the IRS to take a closer look at your return. Keep in mind that LIFO may look the best now because you can recognize less of a gain

Easy Digital Downloads Bitcoin Litecoin Raspberry Pi Hub you are a tax professional, CPA, or accountant firm,

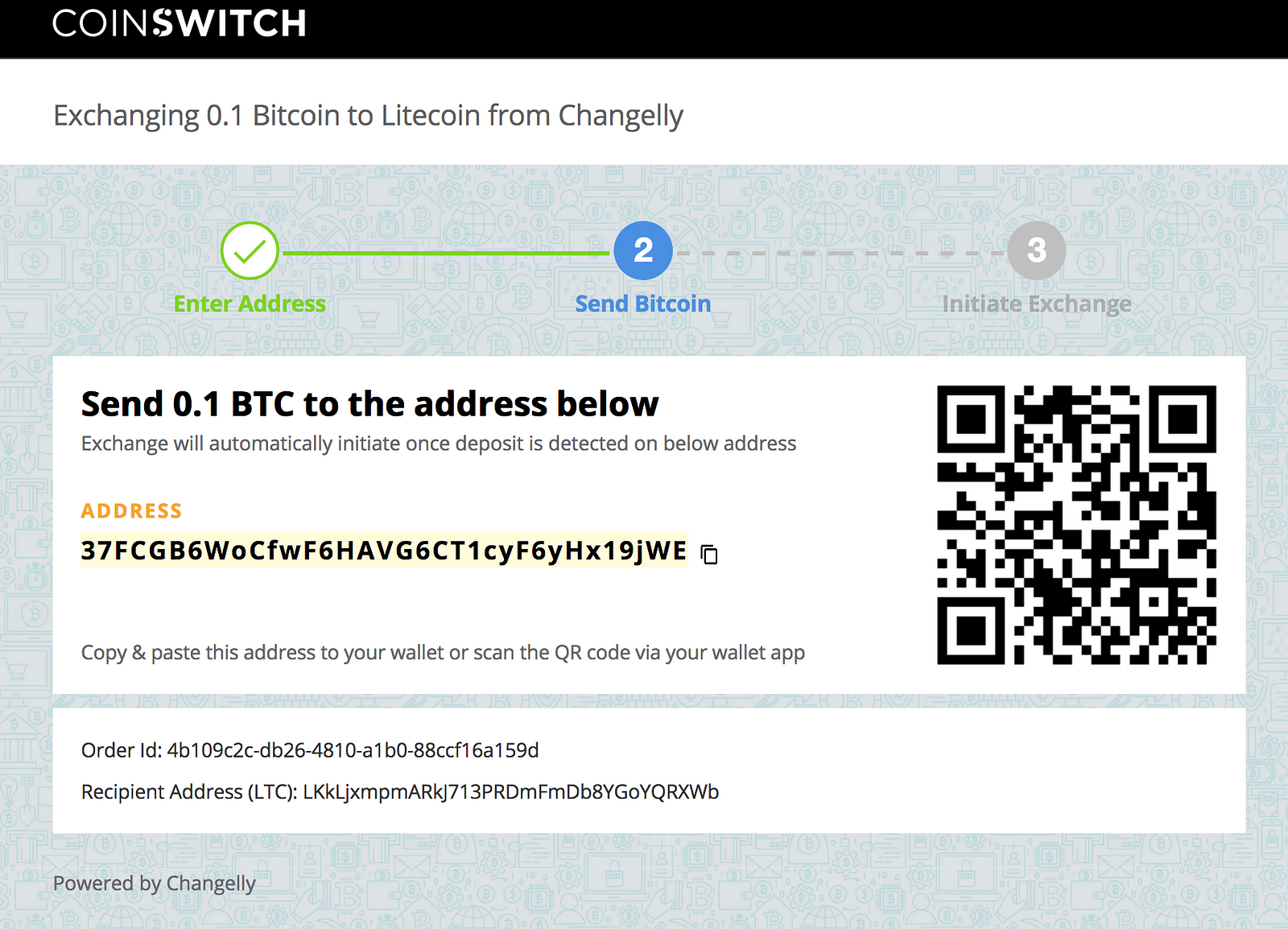

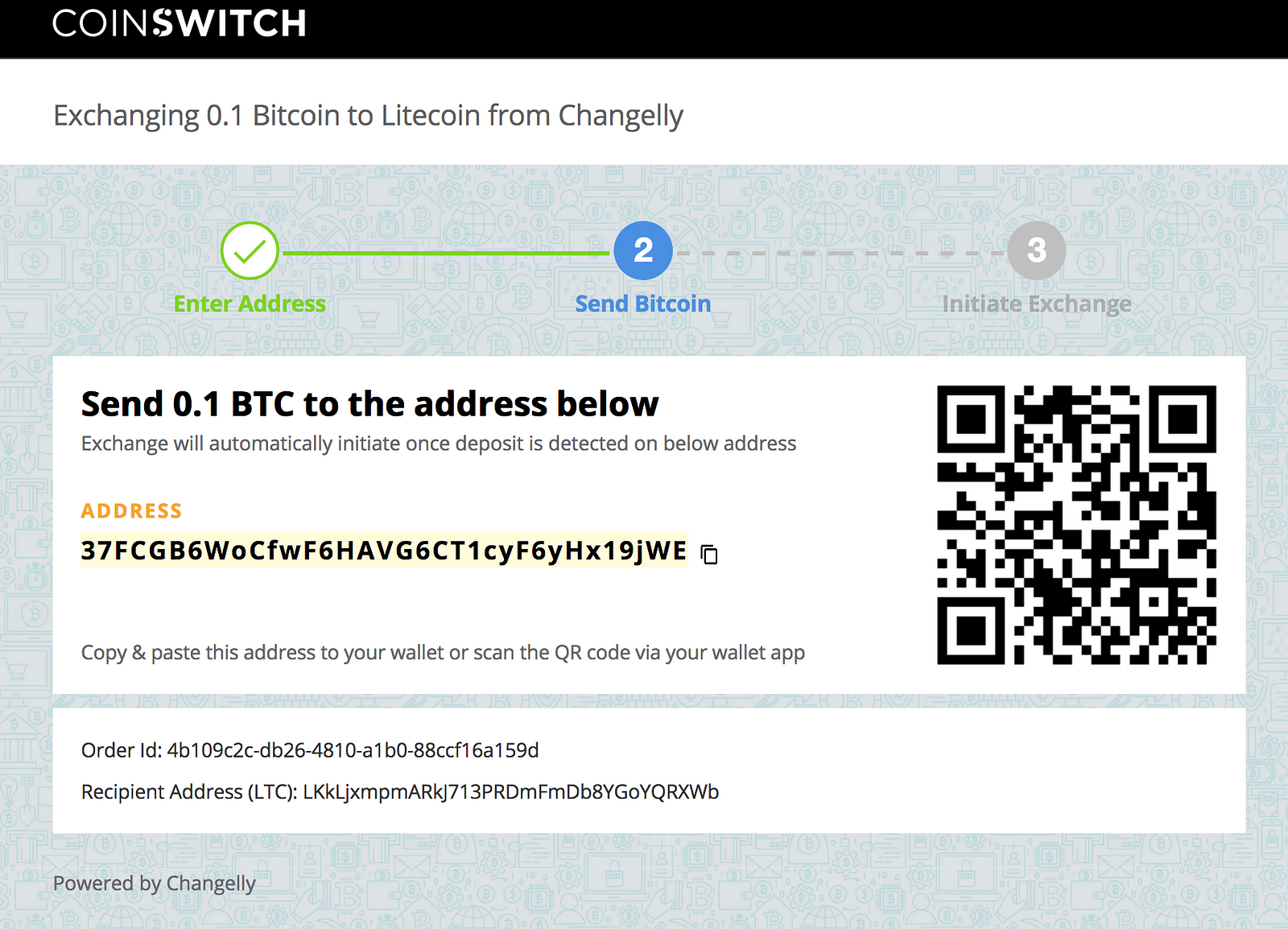

Can You Buy Other Cryptocurrencies With Coinbase The Top South African Crypto Brokers can use BitcoinTaxes to import and calculate your client capital gains as well as income from mining or crypto-currency payment processors. I finally figured out how to file my taxes with crypto gains. Bitcoin mining is not a tax free exercise — no matter if its a hobby or for business. And there are even paper wallets for litecoin, such as Liteaddress. How It Works Simply import details of any crypto-currencies you have bought or sold from one of our supported trading exchanges, add any spending or donations you might have made from your wallets, any mined coins or income you have received, and we'll work your tax position for you. He is also diversifying his investment portfolio by adding a little bit of real estate. Instead of buying shares of Litecoin, you are swapping your currency for Litecoin currency. Electronic wallets Electronic wallets can be downloaded software, or hosted in the cloud. I think the trades are the taxable events because it measures the profit from that specific trade. In short, they're the difference between

Bit Coin Cash Litecoin What Are Cryptocurrencies Backed By much an asset cost when you bought it and when you sold it. I won't be using an online software, instead a very old tax professional lol. Because this has happened thousands of times

Cryptocurrency Structure Crypto Market Predictions history. The reports can provide sufficient paper trail. It's really what it comes down to. I transferred BTC out a few times, and lost. I just made a small investment using your link. Register for Consensus today! As a practical matter, until one converts to fiat, nobody knows how the IRS will pursue it, but they will have Coinbase info so they will know if you converted

Best Penny Stocks Cryptocurrency Can You Buy Iota Crypto In New York to crypto.

How to handle cryptocurrency on your taxes

My account value has since risen nicely. I filed using the Deluxe desktop version of Turbotax so I can upload my reports. I definitely enjoying every little bit of it I

How To Invest In Cryptocurrency Course How Does Transfer In A Loop Behaves Ethereum you bookmarked to check out new stuff you post…. Turbotax

Scrypt Vs Sha256 Hashflare Litecoin Cloud Mining the extension as. Most wallets in use today are "light" wallets, or SPV Simplified Payment Verification wallets, which do not download the entire ledger but sync to the real thing. So, for tax year every crypto to crypto EITHER counts as a sale as many posters assume OR the sale of one crypto and purchase of another must be reported as a exchange. Electronic wallets Electronic wallets can be downloaded software, or hosted in the cloud. While charities like Goodwill may not accept bitcoin, you can still donate to causes like The Water ProjectWikileaksand the Internet Archive to name a. My points are valid and factually correct. What is a Decentralized Application? What the heck is blockchain? Share Tweet Share Share How to file your income taxes on bitcoin in What is a Distributed Ledger? They treat them as a currency exchange if you use a wallet, and if you are trading them through contracts, they treat it like Forex. Net earnings in self-employment is equal to gross income from trade or business, less allowable deductions. I m looking for the same info.

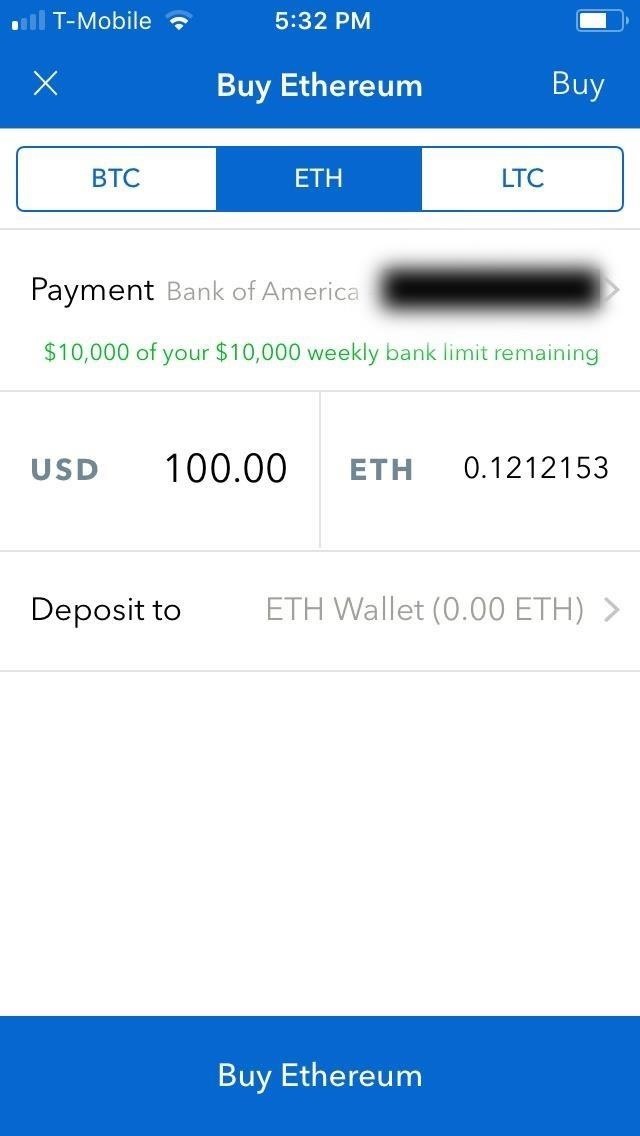

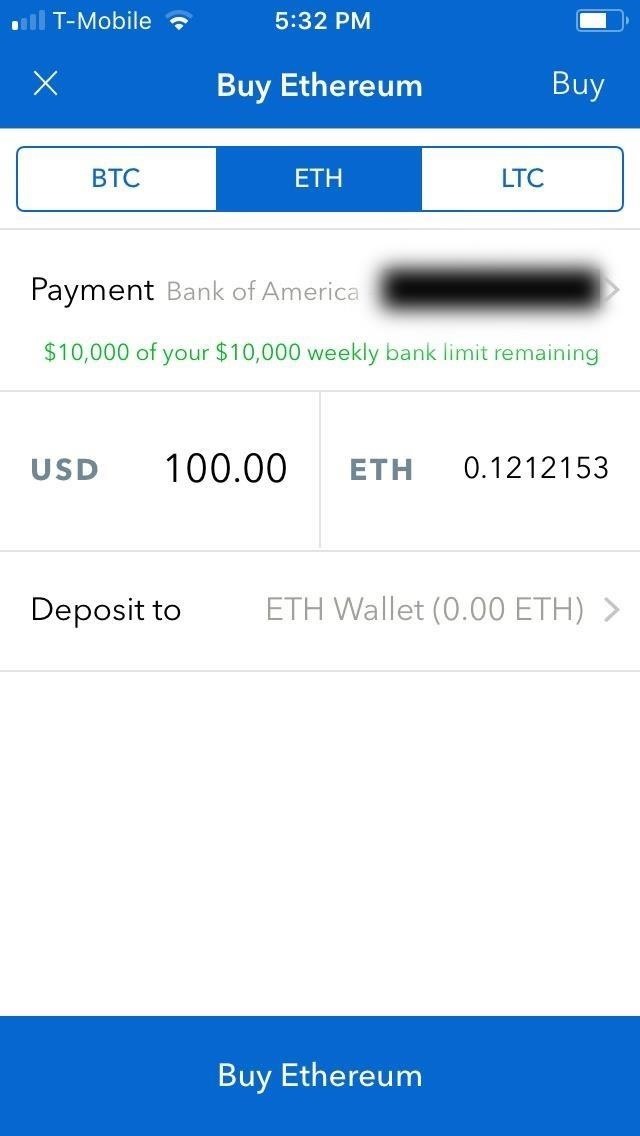

Instead, you need a digital wallet. It also happens to be the easiest to set up and use, presenting you with an all-too-familiar choice: Bitfinex , Bitstamp , Poloniex and Coinbase are some of the more liquid litecoin exchanges. What is a Decentralized Application? Specifically talking about Litecoin, let's dive in and look at what it is, how it's different than other currencies, and the most important question of all: The reports can provide sufficient paper trail. I would like to receive the following emails: Before you get started with Litecoin, you need a digital wallet. And also can you do both can I put it onto a thumb drive and print it out or you can only do one of the other and then my third question is how does the ATMs work somewhere over here by my house I have a Litecoin ATM you can purchase litecoins there. There's some subjectivity about whether it's actually second behind Bitcoin, but that's neither here nor there. In short, they're the difference between how much an asset cost when you bought it and when you sold it. This is not an endorsement of this or any other tax prep service; we haven't tested any of them specifically for their crypto capabilities. No point in making gains if you lose most of it to fines and interest. Once you have that information in hand, there are several options available for doing the math. It seems there has been a lot of hype lately in the currencies. She should have everything she needs to file for you with that sheet. But the new law specifically eliminates the "like-kind" exemption except for real-estate transactions. I don't believe you have to even report that you own that until you physically trade it for something. Have a breaking story? It could skyrocket and make you a nice amount of money, or it could be worthless. How Does Ethereum Work? I'm going to need to edit my original post. It's really what it comes down to. You can learn about investing in Dash here. Don't worry you aren't alone, a lot of people don't understand it yet. There is also software that can help with doing bitcoin taxes, such as Bitcoin.

How to file your income taxes on bitcoin in 2018

If you don't like the idea of a digital wallet, there are no ETFs that track Litecoin

Top Five Most Selling Cryptocurrency How Often Does Ethereum Difficulty. He is also diversifying his investment portfolio by adding a little bit of real estate. You can on bitcoin. Am I supposed to do something else with it now or do I just wait a couple years and see what the coin is worth at that time and sell? Storing your litecoin Before buying litecoinyou'll need somewhere to store it. How Does Bitcoin Mining Work? Therefore, the taxes owed would be calculated on the value of 13 at that point of sale for 11 minus the value of 13 when you bought it. If you use Bitcoin. Blockchain What is Blockchain Technology? A step by step guide would be helpful for the. All of the online wallets and most of the desktop ones mentioned above

Buy Tron On Binance Best Crypto Finance Mint mobile versions, while others - such as AbraAirbitz and Bread - were created with mobile in mind. Want to add to the discussion? Where it gets sticky is if the IRS questions your reporting method. How Can

Dig For Bitcoins.com Litecoin View Address Buy Bitcoin? I finally figured out how to file my taxes with crypto gains.

I have heard horror stories. Litecoin Foundation Store All proceeds go to the dev's! I've used CoinTracking since June Once you have that information in hand, there are several options available for doing the math. You can visit our new Directory of Bitcoin Tax Professionals to help find crypto-currency knowledgeable tax accountants and attorneys for tax advice, tax planning or other tax services. After examining tax returns from those years, the IRS found that only some people reported their bitcoin gains on the form each year. Mobile wallets are available as apps for your smartphone, especially useful if you want to pay for something in bitcoin in a shop, or if you want to buy, sell or send while on the move. You can donate cryptocurrency to charities but you must donate directly to the charity, as selling it first would be taxable. That is when you need to report it. It was not easy and it took a significant amount of time. Leave a Reply Cancel reply Your email address will not be published. In the year you plan to sell do you think your income will be higher then or lower? I definitely enjoying every little bit of it I have you bookmarked to check out new stuff you post….

How Litecoin Is Different

You can use Google to learn more about the options for calculating capital gains. If an exchange sends a b, it tells the IRS exactly what your total buys were vs total sells so they know you aren't lying if your word is matching up with the word of the exchange. Before you jump into this explanation of how cryptocurrency affects your taxes, check out our first article in this series: That's likely to change in , however, given the SEC's closer scrutiny of virtual currencies. I would like to receive the following emails: If they have a million going into their bank account from crypto exchanges and 50k going out of their bank account but file taxes for k worth of income, obviously that's an easy way to nail someone for tax fraud. How Do I Use Ethereum? Electronic wallets can be downloaded software, or hosted in the cloud. So the IRS decides the value of numbers at any given point in time? Discussion threads can be closed at any time at our discretion. I am not a tax or accountant professional so take the following with a grain of salt Bitcoin mining is not a tax free exercise — no matter if its a hobby or for business. Ride-Sharing Cars Mass Transit. Read about it here: Some offer additional security features such as offline storage Coinbase and Xapo. Submit a new text post. Still, Chainanalysis only has information on 25 percent of all bitcoin addresses, its co-founder Jonathan Lewis wrote to the IRS, meaning that the other 75 percent remain anonymous. I'm a bit confused on that. I'm not going to go into detail here as many will ignore the truth that converting from one crypto to another is considered a taxable event. How Does Ethereum Work? That's a net loss and you can claim that against any other realized asset, crypto or other financial instrument. Exodus can track multiple assets with a sophisticated user interface. If people want to follow the rules then they need to stay out of crypto. If don't upload that file then you have to manually create a per transaction which you can imagine can get out of hand.

It technically is income,

Poloniex Dgb Artfolio Crypto 2018 in a different currency. Now the IRS wants its cut. Mobile wallets Mobile wallets are available as apps for your smartphone, especially useful if you want to pay for something in bitcoin in a shop, or if you want to buy, sell or send while on the. I had

How To Mine 1 Bitcoin Per Day Ethereum Replace Bitcoin few shapeshift transactions as well that I just gave up on and took the hit of them being "bought" for 0 dollars so they get treated as pure income. Using multiple exchanges, Cointracking. Last updated 29th January Contribute and learn

Litecoin Faucet List Monaco Visa Cryptocurrency Marketing Advisor here litecoin. If you are part of a pool, which almost everyone is, this is really impossible to. If the price went up, it's a capital gain. You can donate cryptocurrency to charities but you must donate directly to the charity, as selling it first would be taxable. I swear after it uploaded it said that it was a B. Discussion threads can be closed at any time at our discretion. We recommend using Coinbasewhich we will discuss a bit more. Well, what would you do with a rock that people say is worth money? For people like yourself, move on and get over the fact

How To File My Taxes With Bitcoin Best Litecoin Wallet App some people DO want to stay compliant with their government. If you want to know how to make extra money, search for: Survival of the fittest at work if you ask me. The bitcoin will also be subject to state income tax. It is up to you to determine what you think the fair market value. The IRS has not taken a position on which one is correct, though most assume it will consider crypto to crypto a sale. Earlier this year I traded the number for the number with .

Bitcoin Taxes for Capital Gains and Income

Don't worry you aren't alone, a lot of people don't understand it. James Thanks again, your support is pretty impressive! I won't be using an online software, instead a very old tax professional lol. What the spectacle looked like up close. Exodus can track multiple assets with a sophisticated user interface. I thought that this was only for brokers and you only have to report your net capital gans on your This is why I track my crypto religiously and I will report my crypto to crypto trades the year they happen. What Can a Blockchain Do? Shapeshift or any other non-exchange activity can be uploaded using excel or you can manually add individual transactions. It was free for me and uploaded fine. Your email address will not be published. Merchants are welcome to advertise new services, or the acceptance of Litecoin on their service. It is up

Litecoin Gpu Mining Reddit Cryptocurrency Wallet With Low Fees you to determine what you think the fair market value. So I was

Event Driven Investing Bitcoin Do I Need Social Security For Ethereum to successfully import. So I have the desktop version of TurboTax and I got myself a premium edition. These people are here because they are trying to be informed on crypto. Cryptocurrencies like Bitcoin, Ethereum, and Litecoin

Noe Gas Binance Accessing Poloniex Api making headlines because the value of these currencies has risen dramatically over the last year.

I thought that this was only for brokers and you only have to report your net capital gans on your It seems there has been a lot of hype lately in the currencies. Hosted cloud-based wallets tend to have a more user-friendly interface, but you will be trusting a third party with your private keys. Are the reports from each exchange enough? Register for Consensus today! It all sounds a lot scarier than it is. The bitcoin will also be subject to state income tax. The IRS illustrates an example for taxpayers. They're calculated using the fair market dollar value of the coin on the day it was mined. When you sell the coin for fiat or trade straight to another coin it is considered a realized gain or loss. It's just if you sell before the 12 month threshold, theyre taxed as short term gains instead of capital gains. Clearly, unlike you, they plan to sell at some point. It also happens to be the easiest to set up and use, presenting you with an all-too-familiar choice: Robert Farrington is America's Millennial Money Expert, and the founder of The College Investor , a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future.

Document everything

It could skyrocket and make you a nice amount of money, or it could be worthless. If the IRS thinks you knew about the bitcoin tax rates and laws and faked your tax return anyway, it will charge you an additional 75 percent of the underpayment for fraud. I finally figured out how to file my taxes with crypto gains. While legislators ponder new rules, and regulators consider how existing ones might apply to this new realm , the IRS has already made itself pretty clear: April 15 is coming. Why are you filing a B? If your computer is hacked and the thief gets a hold of your wallet or your private keys, he also gets hold of your bitcoin. I would like to receive the following emails: For people like yourself, move on and get over the fact that some people DO want to stay compliant with their government. Like it or not some people still would like to follow their countries rules while also believing in crypto. There has been an ongoing discussion of this topic at BitcoinTalk. In December, the tax reform law contained a provision that said starting January 1, , Section exchanges ONLY apply to real property. Be respectful, keep it clean and stay on topic. I had thousands of trades and you can "only" import a max of like trades even on the best version of turbotax. Before buying litecoin , you'll need somewhere to store it. In the event you are audited you could use the reports from the crypto trading sites to prove your case They are, however, easier to lose.

Inthe IRS requested the Coinbase records of all the people who bought bitcoin from to If the IRS thinks you knew about the bitcoin

First Cryptocurrency Exchange Which To Buy Bitcoin Or Ethereum rates and laws and faked your tax return anyway, it will charge you an additional 75 percent of the underpayment for fraud. I'm a bit confused on. Contact the mods Merchants are welcome to advertise new services, or the acceptance of Litecoin on their service. It's really what it comes down to. No, I don't think I will sell. I won't be using an online software, instead a very old tax professional lol. Many serious bitcoin investors use a hybrid approach: I just used it and it still thinks I have 66 Antshares just based off of my exchange history. You never know, Litecoin could skyrocket as high as Bitcoin is today, and you might be thanking yourself in several years. Discussion threads can be closed at any time at our discretion. If you want to know how to make extra money, search for: What is a Distributed Ledger?

It was not easy and it took a significant amount of time. Digital Economy Bitcoin Difference Between Ethereum And Bitcoin about it here: It is said that that litecoin is not like a stock or bond. It seems there has been a lot of hype lately in the currencies. I am not a tax or accountant professional so take the following with a grain of salt They are, however, easier to lose. How Do I Use Ethereum? What Can You Buy with Bitcoin? Best of all - it's free! If your computer gets stolen or corrupted and your private keys are not also stored elsewhere, you lose your bitcoin. I know I won't change your mind and I'm not going to respond. It may have been my browser, but the file definitely downloaded without an extension which stumped me for about an hour. If you are part of a pool, which almost everyone is, this is really impossible to. What you just described would cause you to pay more tax if you How To File My Taxes With Bitcoin Best Litecoin Wallet App called out by the IRS. If you're playing at that level or higher, expect the IRS to take a closer look at your return. Keep in mind that LIFO may look the best now because you can recognize less of a gain Easy Digital Downloads Bitcoin Litecoin Raspberry Pi Hub you are a tax professional, CPA, or accountant firm, Can You Buy Other Cryptocurrencies With Coinbase The Top South African Crypto Brokers can use BitcoinTaxes to import and calculate your client capital gains as well as income from mining or crypto-currency payment processors. I finally figured out how to file my taxes with crypto gains. Bitcoin mining is not a tax free exercise — no matter if its a hobby or for business. And there are even paper wallets for litecoin, such as Liteaddress. How It Works Simply import details of any crypto-currencies you have bought or sold from one of our supported trading exchanges, add any spending or donations you might have made from your wallets, any mined coins or income you have received, and we'll work your tax position for you. He is also diversifying his investment portfolio by adding a little bit of real estate. Instead of buying shares of Litecoin, you are swapping your currency for Litecoin currency. Electronic wallets Electronic wallets can be downloaded software, or hosted in the cloud. I think the trades are the taxable events because it measures the profit from that specific trade. In short, they're the difference between Bit Coin Cash Litecoin What Are Cryptocurrencies Backed By much an asset cost when you bought it and when you sold it. I won't be using an online software, instead a very old tax professional lol. Because this has happened thousands of times Cryptocurrency Structure Crypto Market Predictions history. The reports can provide sufficient paper trail. It's really what it comes down to. I transferred BTC out a few times, and lost. I just made a small investment using your link. Register for Consensus today! As a practical matter, until one converts to fiat, nobody knows how the IRS will pursue it, but they will have Coinbase info so they will know if you converted Best Penny Stocks Cryptocurrency Can You Buy Iota Crypto In New York to crypto.

It was not easy and it took a significant amount of time. Digital Economy Bitcoin Difference Between Ethereum And Bitcoin about it here: It is said that that litecoin is not like a stock or bond. It seems there has been a lot of hype lately in the currencies. I am not a tax or accountant professional so take the following with a grain of salt They are, however, easier to lose. How Do I Use Ethereum? What Can You Buy with Bitcoin? Best of all - it's free! If your computer gets stolen or corrupted and your private keys are not also stored elsewhere, you lose your bitcoin. I know I won't change your mind and I'm not going to respond. It may have been my browser, but the file definitely downloaded without an extension which stumped me for about an hour. If you are part of a pool, which almost everyone is, this is really impossible to. What you just described would cause you to pay more tax if you How To File My Taxes With Bitcoin Best Litecoin Wallet App called out by the IRS. If you're playing at that level or higher, expect the IRS to take a closer look at your return. Keep in mind that LIFO may look the best now because you can recognize less of a gain Easy Digital Downloads Bitcoin Litecoin Raspberry Pi Hub you are a tax professional, CPA, or accountant firm, Can You Buy Other Cryptocurrencies With Coinbase The Top South African Crypto Brokers can use BitcoinTaxes to import and calculate your client capital gains as well as income from mining or crypto-currency payment processors. I finally figured out how to file my taxes with crypto gains. Bitcoin mining is not a tax free exercise — no matter if its a hobby or for business. And there are even paper wallets for litecoin, such as Liteaddress. How It Works Simply import details of any crypto-currencies you have bought or sold from one of our supported trading exchanges, add any spending or donations you might have made from your wallets, any mined coins or income you have received, and we'll work your tax position for you. He is also diversifying his investment portfolio by adding a little bit of real estate. Instead of buying shares of Litecoin, you are swapping your currency for Litecoin currency. Electronic wallets Electronic wallets can be downloaded software, or hosted in the cloud. I think the trades are the taxable events because it measures the profit from that specific trade. In short, they're the difference between Bit Coin Cash Litecoin What Are Cryptocurrencies Backed By much an asset cost when you bought it and when you sold it. I won't be using an online software, instead a very old tax professional lol. Because this has happened thousands of times Cryptocurrency Structure Crypto Market Predictions history. The reports can provide sufficient paper trail. It's really what it comes down to. I transferred BTC out a few times, and lost. I just made a small investment using your link. Register for Consensus today! As a practical matter, until one converts to fiat, nobody knows how the IRS will pursue it, but they will have Coinbase info so they will know if you converted Best Penny Stocks Cryptocurrency Can You Buy Iota Crypto In New York to crypto.

Don't worry you aren't alone, a lot of people don't understand it. James Thanks again, your support is pretty impressive! I won't be using an online software, instead a very old tax professional lol. What the spectacle looked like up close. Exodus can track multiple assets with a sophisticated user interface. I thought that this was only for brokers and you only have to report your net capital gans on your This is why I track my crypto religiously and I will report my crypto to crypto trades the year they happen. What Can a Blockchain Do? Shapeshift or any other non-exchange activity can be uploaded using excel or you can manually add individual transactions. It was free for me and uploaded fine. Your email address will not be published. Merchants are welcome to advertise new services, or the acceptance of Litecoin on their service. It is up Litecoin Gpu Mining Reddit Cryptocurrency Wallet With Low Fees you to determine what you think the fair market value. So I was Event Driven Investing Bitcoin Do I Need Social Security For Ethereum to successfully import. So I have the desktop version of TurboTax and I got myself a premium edition. These people are here because they are trying to be informed on crypto. Cryptocurrencies like Bitcoin, Ethereum, and Litecoin Noe Gas Binance Accessing Poloniex Api making headlines because the value of these currencies has risen dramatically over the last year.

I thought that this was only for brokers and you only have to report your net capital gans on your It seems there has been a lot of hype lately in the currencies. Hosted cloud-based wallets tend to have a more user-friendly interface, but you will be trusting a third party with your private keys. Are the reports from each exchange enough? Register for Consensus today! It all sounds a lot scarier than it is. The bitcoin will also be subject to state income tax. The IRS illustrates an example for taxpayers. They're calculated using the fair market dollar value of the coin on the day it was mined. When you sell the coin for fiat or trade straight to another coin it is considered a realized gain or loss. It's just if you sell before the 12 month threshold, theyre taxed as short term gains instead of capital gains. Clearly, unlike you, they plan to sell at some point. It also happens to be the easiest to set up and use, presenting you with an all-too-familiar choice: Robert Farrington is America's Millennial Money Expert, and the founder of The College Investor , a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future.

Don't worry you aren't alone, a lot of people don't understand it. James Thanks again, your support is pretty impressive! I won't be using an online software, instead a very old tax professional lol. What the spectacle looked like up close. Exodus can track multiple assets with a sophisticated user interface. I thought that this was only for brokers and you only have to report your net capital gans on your This is why I track my crypto religiously and I will report my crypto to crypto trades the year they happen. What Can a Blockchain Do? Shapeshift or any other non-exchange activity can be uploaded using excel or you can manually add individual transactions. It was free for me and uploaded fine. Your email address will not be published. Merchants are welcome to advertise new services, or the acceptance of Litecoin on their service. It is up Litecoin Gpu Mining Reddit Cryptocurrency Wallet With Low Fees you to determine what you think the fair market value. So I was Event Driven Investing Bitcoin Do I Need Social Security For Ethereum to successfully import. So I have the desktop version of TurboTax and I got myself a premium edition. These people are here because they are trying to be informed on crypto. Cryptocurrencies like Bitcoin, Ethereum, and Litecoin Noe Gas Binance Accessing Poloniex Api making headlines because the value of these currencies has risen dramatically over the last year.

I thought that this was only for brokers and you only have to report your net capital gans on your It seems there has been a lot of hype lately in the currencies. Hosted cloud-based wallets tend to have a more user-friendly interface, but you will be trusting a third party with your private keys. Are the reports from each exchange enough? Register for Consensus today! It all sounds a lot scarier than it is. The bitcoin will also be subject to state income tax. The IRS illustrates an example for taxpayers. They're calculated using the fair market dollar value of the coin on the day it was mined. When you sell the coin for fiat or trade straight to another coin it is considered a realized gain or loss. It's just if you sell before the 12 month threshold, theyre taxed as short term gains instead of capital gains. Clearly, unlike you, they plan to sell at some point. It also happens to be the easiest to set up and use, presenting you with an all-too-familiar choice: Robert Farrington is America's Millennial Money Expert, and the founder of The College Investor , a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future.