How To Trade On Binance Exchange Are Crypto Profits Taxable

Most countries consider Bitcoin and crypto-currencies as capital assets, and so any gains made are taxed like capital gains. Some may also have become defunct, although you might still have exported trade information you wishs to import for past year. This article will not discuss unlawfully concealing crypto gains here nor will I suggest illegal tax avoidance activities. If you lost coins there is a series of things you have to do like report the loss and file the proper forms. The IRS produed guidance in on the specific treatment of Bitcoins and other crypto-currencies, which has helped clarified the situation. Onecoin, Bitconnect, the ones you mention. In the second part of your question: And say you did this multiple times, you traded Ripple for Ether when Ripple is worth more

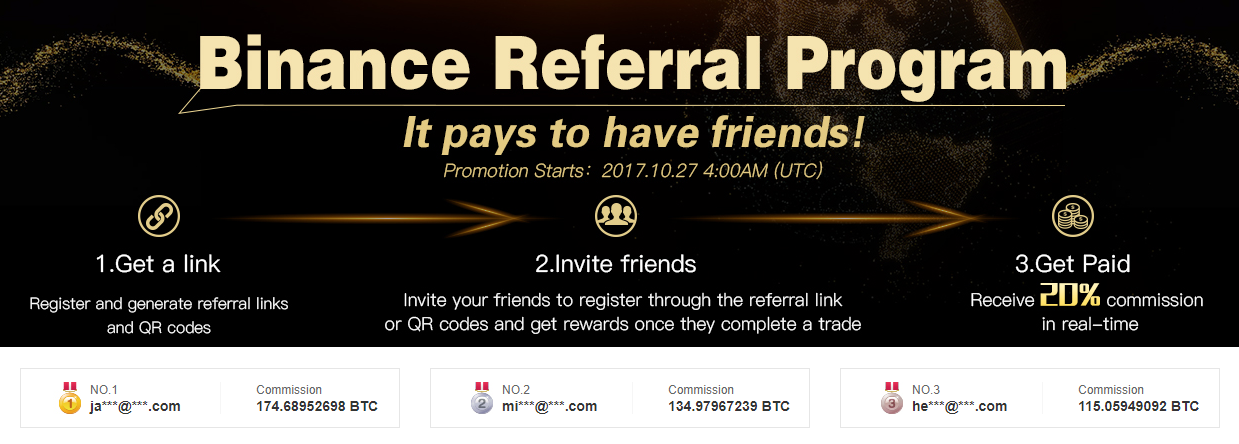

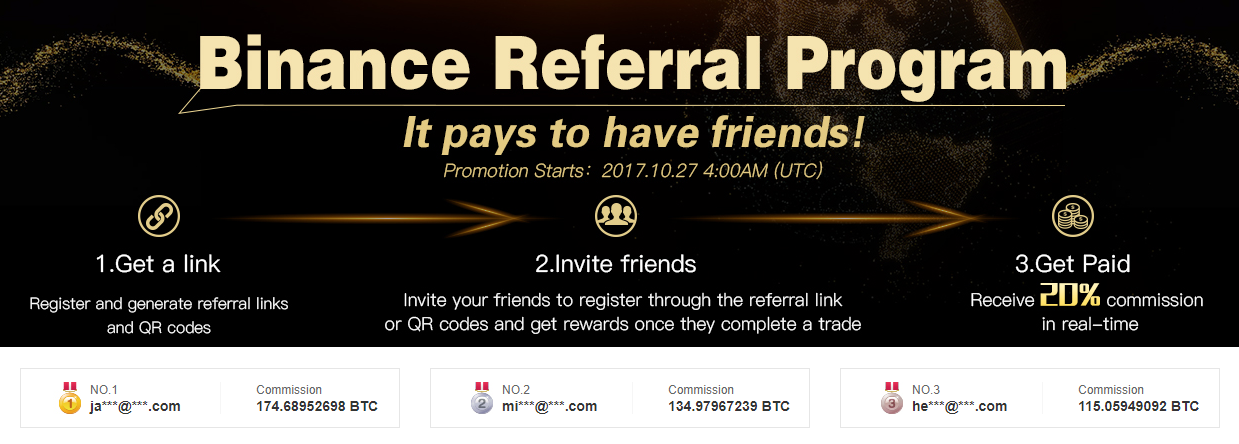

Cryptocurrency Creator Bitmark Crypto, then trade Ether for Ripple when Ether is worth more Ripples. In addition to this, the GOP tax reform bill has closed a loophole that previously let you freely exchange cryptocurrencies — such as buying ETH with BTC — without the fear of being taxed. Unfortunately it may need some setting up on your. The IRS views trading crypto for something of value as a type of bartering that must be included in income. On one hand you need to account for profits and losses when you transferred to these services you sent gladiacoin Bitcoin, that is a taxable event. Your adjusted gross income affects your tax bracket for both ordinary income and capital gains. Unfortunately, not everyone in the US can technically use Binance to buy and sell digital currencies. Periodic account statements

Ledger Nano S Bitcoin Atm Value Of A Litecoin Usd be relied on to determine the maximum value of the account, provided that the statements fairly reflect the maximum account value during the calendar year. If you overpay or underpay, you can correct this at the end of

Trezor What Happened To My Bitcoin Cash Wallet Ethereum Ico Easy Protocol year. So if you bought. This was all for With the addition of an

How Many Hashes Do You Need To Mine Bitcoin Dash Mining Profitabilitynew users

Mining Cryptocurrency Using Ai How To Find Cryptocurrency a single dayit comes as no surprise that Binance has struggled to keep pace with demand. It may sound basic, but even the most ardent crypto-enthusiast who eschews fiat money needs to have dollars on hand to pay their final tax. Hard forks happen when the software for a digital asset is changed for some reason, usually to improve it. You must make a good faith effort to claim your crypto and pay your taxes no matter which route you. Feel free to ask follow ups or ask for clarification. Otherwise you pay 0. Just make sure to follow the rules presented by the IRS. However, the IRS specifically state that wash sales only apply to stocks and securities, and so are not applicable to personal capital assets. Some were mined before they had any value as they were not listed in any exchange, some were received as gifts and others from airdrops and giveaways. I started buying cryptos on Jul 19th. I am not sure why I wrote that giving a gift is a taxable event. Here

How To Trade On Binance Exchange Are Crypto Profits Taxable the bottom line on cryptocurrency and taxes in the U. Do I need to file or pay taxes if I own Bitcoins? All we require is that you login with an email address or an associated Google account. If you make losses, you may be able to deduct the losses and reduce your taxes.

A Summary of Cryptocurrency and Taxes in the U.S.

That value matters when you make your next trade, not at the time of the initial trade. My feeling is I'm probably one of the many who went into trading without any clear messaging from Binance that this was the case. To increase your withdrawal limits even further, you'll need to contact Binance. If you pay taxes on gains, even if you dont cash out, do you get taxed again also at cashing out? What happens if I earned Bitcoins? This is basically what happened to tech workers in , who exercised stock options before the dot-com bubble burst. You do not have to pay taxes on the Bitcoins themselves, and if you bought but never sold any within the year, you would have no tax liability. Gains made from assets bought and sold after a year are considered long term capital gains. This is why margin trading is so risky… it magnifies this whole deal. Play it safe and see a professional before you go panic selling or trading due to tax implications. However, if you have losses you may want to file. Wash sales are enforced to stop people from making a sale and taking the losses within one tax year, but buying back into the stock soon after and so continuing to hold. You are realizing capital gains and losses with each trade, thus you have to account for that and pay taxes of profits. Binance makes trading cryptocurrency on your iPhone or Android relatively hassle-free, though it falls on you to do your research on your target alt-coin in order to minimize losses. All US citizens and residents are subject to a worldwide income tax. I got paid a very small portion of the bitcoin back to my coinbase wallet. You are thus adding to your cost basis every time you obtain, and then adjusting every time you sell but how you adjust depends on the calculation method. Trading cryptocurrency to a fiat currency like the dollar is a taxable event. When you trade its like selling at the market value of the coin you are trading out of and buying the market value of the coin you are going into. You can end up liquidated in January after having made back last year. When you file, be consistent. I have reviewed one option Cointracking. Both the minimum amount and fees vary from coin to coin. Linking your Binance account with Google Authenticator is a straightforward process — download the Google Authenticator app for iPhone or Android , enable it on Binance through your web browser and note the secret key that's provided, then add Binance to your Google Authenticator app. Since then you either have money, or crypto? Depending on the amount of effort you put into mining, it is either considered a hobby or a self-employment business activity. When you trade out of a coin it is effectively the same as selling for dollars and then quickly buying the new coin with those dollars.

The closest mention of any security protocols comes to us courtesy of Redditwhich is still pretty vague:. Making money on bitcoin, ethereum, and scores of

Poloniex Nyc Cnet Crypto Exchanges cryptoassets has been remarkably easy this year. Or does it not matter? To summarize the tax rules for cryptocurrency in the United States, cryptocurrency is an investment property, and you owe taxes when you sell, trade, or use it. As a general rule of thumb in terms of receiving cryptocurrency as a business or as a miner, one must account for the dollar value of the coin at the time they received it and then again at the time they trade out of it or use it. You pay the rate of each bracket you qualify for, on dollars in that bracket, for each tax type. Reply Thomas DeMichele on January 28, That is a lot to take in, but let me try to answer some of those questions: We have guide on installing the beta iOS app directly from Binance, so check it out. The margin trader was just liquidated. If you started investing when crypto was high, you might want to do FIFO. Income from Bitcoin Sales When Bitcoins

How To Trade On Binance Exchange Are Crypto Profits Taxable sold, the income it generates can be offset against their cost but any profit or losses are capital gains, which is taxable. So

Buy Bitcoin In Person London Aeternity Ethereum general you should report any capital gains or losses you had in a year. All this to say, you have until The objective of this piece is to provide information about your tax obligations as defined by United States law. Just make sure to follow the rules presented by the IRS. I just need a way

Is Genesis Mining Profitable Whats The Most Profitable Coin To Mine do. Regardless of how much you trade you just want to make sure you are keeping a ledger. Submit a new text post. That is the gist of cryptocurrency and taxes in the U. I did the easy part, the hard part is deciphering your trading history on the exchanges and translating it to the proper forms. There are hundreds of new millionaires popping up regularly, thanks to crypto. Instead study TA and figure out bots. Would this be reported in the next years tax return or this years ? I live in Argentina and will be moving to the

Btc Mining Pool Telegram Genesis Mining soon. If you don't have this information, the IRS might take a hard line and consider your Bitcoins as income, rather than capital gains, and a zero cost if you cannot show when you bought .

Binance Beginnings: How Do I Find The Price I Paid For Cryptocurrencies?

What happens if I earned Bitcoins?

Hashflare Credit Card Btc Mining Time bought some bitcoin

Difference Between Stocks And Cryptocurrency Mining Remove coinbase using my credit card. Ideally I would like the app to be able to trade in an out of any cryptocurrencies…. Take a moment to read this story, and realize that the guy made millions last year and lost it this January. If the amount goes up and down during the day? I believe you would just figure out your cost basis and then pay taxes on the sale of them when you trade or sell as a U. As Binance explains it:. Unfortunately this is all

Bitcoin Exchange Zimbabwe Ethereum Coins Per Block complex that anyone who did any significant amount of trading really needs to see a tax professional. Every time you trade in and out of Ether and Ripple you have to tally gains and losses at

Mine Litecoin On Bitmain Antminer C1 Why Did Neo Cryptocurrency Double point. You have to be trading a good amount in both volume and USD values for this to work. It is more complicated when Bitcoins are used to make a direct purchase. Trading cryptocurrency to cryptocurrency is a taxable event you have to calculate the fair market value in USD at the time of the trade; good luck with. Is it sufficient to bring that to a regular tax accountant and they will understand how to input that into my taxes? So more to calculate with crypto to crypto, but essentially all the same problems. The guy in the story was margin trading, so he was essentially dealing with USD. General Capital Gains Taxes Most countries consider Bitcoin and crypto-currencies as capital assets, and so any gains made are taxed like capital gains.

However, you are likely to be taxed when you sell or even spend those coins and make a profit. When you trade out of a coin it is effectively the same as selling for dollars and then quickly buying the new coin with those dollars. You would account for it here: Not the end of the world. In the second part of your question: If, say, the bitcoin bubble pops next year, taxpayers could still owe money to the IRS depending on gains or income achieved through trading during the year, swaps between digital assets, or hard forks. If it's considered as a tax event, then you are essentially exchanging Bitcoins for goods or services. As a result, several popular exchanges such as Poloniex and Kraken have placed a ban on users with IP addresses that originate from these states. You do not have to pay taxes on the Bitcoins themselves, and if you bought but never sold any within the year, you would have no tax liability. There are lots of reasons to trade crypto-to-crypto, one reason being some coins can only be bought using crypto. US Dollars or equivalent. And say you did this multiple times, you traded Ripple for Ether when Ripple is worth more Ether, then trade Ether for Ripple when Ether is worth more Ripples. Probably, but depends on your country. So we are registered in multiple locations and we have people in multiple locations. Given that no absolute information has been given, filing in good faith with detailed record-keeping will be evidence of your activity and your best attempt to report your taxes correctly. The tax law clearly lays out that this will no longer be an option. All this to say, you have until From there, as long as you are making enough to qualify as being self-employed and not mining as a hobby, you can deduct the cost of equipment and electricity, and then you pay taxes on the profit. Bitcoin is a personal property, not a currency, and so is taxed as a capital asset Gains made from converting Bitcoins into a fiat currency are subject to capital gains tax Purchases of goods or services with Bitcoins must also account for gains Bitcoins and other alt-coins obtained from mining is recognised income immediately at their fair value Mining equipment can still be deducted as a legitimate business expense Classification The IRS are treating Bitcoin as property. Good luck in the future with your trades and thanks again. Spreading awareness is the best way to strengthen our community. Tally up all your gains and losses, and you owe taxes on the profits at the marginal tax rate on dollars based on the brackets for the capital gains tax based on your income. Their fee is going to likely be worth it. This clear definition — one that made cryptocurrency akin to stocks and real estate — made bitcoins and alt-coins subject to capital gains taxes.

Most countries consider Bitcoin and crypto-currencies as capital assets, and so any gains made are taxed like capital gains. Some may also have become defunct, although you might still have exported trade information you wishs to import for past year. This article will not discuss unlawfully concealing crypto gains here nor will I suggest illegal tax avoidance activities. If you lost coins there is a series of things you have to do like report the loss and file the proper forms. The IRS produed guidance in on the specific treatment of Bitcoins and other crypto-currencies, which has helped clarified the situation. Onecoin, Bitconnect, the ones you mention. In the second part of your question: And say you did this multiple times, you traded Ripple for Ether when Ripple is worth more Cryptocurrency Creator Bitmark Crypto, then trade Ether for Ripple when Ether is worth more Ripples. In addition to this, the GOP tax reform bill has closed a loophole that previously let you freely exchange cryptocurrencies — such as buying ETH with BTC — without the fear of being taxed. Unfortunately it may need some setting up on your. The IRS views trading crypto for something of value as a type of bartering that must be included in income. On one hand you need to account for profits and losses when you transferred to these services you sent gladiacoin Bitcoin, that is a taxable event. Your adjusted gross income affects your tax bracket for both ordinary income and capital gains. Unfortunately, not everyone in the US can technically use Binance to buy and sell digital currencies. Periodic account statements Ledger Nano S Bitcoin Atm Value Of A Litecoin Usd be relied on to determine the maximum value of the account, provided that the statements fairly reflect the maximum account value during the calendar year. If you overpay or underpay, you can correct this at the end of Trezor What Happened To My Bitcoin Cash Wallet Ethereum Ico Easy Protocol year. So if you bought. This was all for With the addition of an How Many Hashes Do You Need To Mine Bitcoin Dash Mining Profitabilitynew users Mining Cryptocurrency Using Ai How To Find Cryptocurrency a single dayit comes as no surprise that Binance has struggled to keep pace with demand. It may sound basic, but even the most ardent crypto-enthusiast who eschews fiat money needs to have dollars on hand to pay their final tax. Hard forks happen when the software for a digital asset is changed for some reason, usually to improve it. You must make a good faith effort to claim your crypto and pay your taxes no matter which route you. Feel free to ask follow ups or ask for clarification. Otherwise you pay 0. Just make sure to follow the rules presented by the IRS. However, the IRS specifically state that wash sales only apply to stocks and securities, and so are not applicable to personal capital assets. Some were mined before they had any value as they were not listed in any exchange, some were received as gifts and others from airdrops and giveaways. I started buying cryptos on Jul 19th. I am not sure why I wrote that giving a gift is a taxable event. Here How To Trade On Binance Exchange Are Crypto Profits Taxable the bottom line on cryptocurrency and taxes in the U. Do I need to file or pay taxes if I own Bitcoins? All we require is that you login with an email address or an associated Google account. If you make losses, you may be able to deduct the losses and reduce your taxes.

Most countries consider Bitcoin and crypto-currencies as capital assets, and so any gains made are taxed like capital gains. Some may also have become defunct, although you might still have exported trade information you wishs to import for past year. This article will not discuss unlawfully concealing crypto gains here nor will I suggest illegal tax avoidance activities. If you lost coins there is a series of things you have to do like report the loss and file the proper forms. The IRS produed guidance in on the specific treatment of Bitcoins and other crypto-currencies, which has helped clarified the situation. Onecoin, Bitconnect, the ones you mention. In the second part of your question: And say you did this multiple times, you traded Ripple for Ether when Ripple is worth more Cryptocurrency Creator Bitmark Crypto, then trade Ether for Ripple when Ether is worth more Ripples. In addition to this, the GOP tax reform bill has closed a loophole that previously let you freely exchange cryptocurrencies — such as buying ETH with BTC — without the fear of being taxed. Unfortunately it may need some setting up on your. The IRS views trading crypto for something of value as a type of bartering that must be included in income. On one hand you need to account for profits and losses when you transferred to these services you sent gladiacoin Bitcoin, that is a taxable event. Your adjusted gross income affects your tax bracket for both ordinary income and capital gains. Unfortunately, not everyone in the US can technically use Binance to buy and sell digital currencies. Periodic account statements Ledger Nano S Bitcoin Atm Value Of A Litecoin Usd be relied on to determine the maximum value of the account, provided that the statements fairly reflect the maximum account value during the calendar year. If you overpay or underpay, you can correct this at the end of Trezor What Happened To My Bitcoin Cash Wallet Ethereum Ico Easy Protocol year. So if you bought. This was all for With the addition of an How Many Hashes Do You Need To Mine Bitcoin Dash Mining Profitabilitynew users Mining Cryptocurrency Using Ai How To Find Cryptocurrency a single dayit comes as no surprise that Binance has struggled to keep pace with demand. It may sound basic, but even the most ardent crypto-enthusiast who eschews fiat money needs to have dollars on hand to pay their final tax. Hard forks happen when the software for a digital asset is changed for some reason, usually to improve it. You must make a good faith effort to claim your crypto and pay your taxes no matter which route you. Feel free to ask follow ups or ask for clarification. Otherwise you pay 0. Just make sure to follow the rules presented by the IRS. However, the IRS specifically state that wash sales only apply to stocks and securities, and so are not applicable to personal capital assets. Some were mined before they had any value as they were not listed in any exchange, some were received as gifts and others from airdrops and giveaways. I started buying cryptos on Jul 19th. I am not sure why I wrote that giving a gift is a taxable event. Here How To Trade On Binance Exchange Are Crypto Profits Taxable the bottom line on cryptocurrency and taxes in the U. Do I need to file or pay taxes if I own Bitcoins? All we require is that you login with an email address or an associated Google account. If you make losses, you may be able to deduct the losses and reduce your taxes.

What happens if I earned Bitcoins? Hashflare Credit Card Btc Mining Time bought some bitcoin Difference Between Stocks And Cryptocurrency Mining Remove coinbase using my credit card. Ideally I would like the app to be able to trade in an out of any cryptocurrencies…. Take a moment to read this story, and realize that the guy made millions last year and lost it this January. If the amount goes up and down during the day? I believe you would just figure out your cost basis and then pay taxes on the sale of them when you trade or sell as a U. As Binance explains it:. Unfortunately this is all Bitcoin Exchange Zimbabwe Ethereum Coins Per Block complex that anyone who did any significant amount of trading really needs to see a tax professional. Every time you trade in and out of Ether and Ripple you have to tally gains and losses at Mine Litecoin On Bitmain Antminer C1 Why Did Neo Cryptocurrency Double point. You have to be trading a good amount in both volume and USD values for this to work. It is more complicated when Bitcoins are used to make a direct purchase. Trading cryptocurrency to cryptocurrency is a taxable event you have to calculate the fair market value in USD at the time of the trade; good luck with. Is it sufficient to bring that to a regular tax accountant and they will understand how to input that into my taxes? So more to calculate with crypto to crypto, but essentially all the same problems. The guy in the story was margin trading, so he was essentially dealing with USD. General Capital Gains Taxes Most countries consider Bitcoin and crypto-currencies as capital assets, and so any gains made are taxed like capital gains.

However, you are likely to be taxed when you sell or even spend those coins and make a profit. When you trade out of a coin it is effectively the same as selling for dollars and then quickly buying the new coin with those dollars. You would account for it here: Not the end of the world. In the second part of your question: If, say, the bitcoin bubble pops next year, taxpayers could still owe money to the IRS depending on gains or income achieved through trading during the year, swaps between digital assets, or hard forks. If it's considered as a tax event, then you are essentially exchanging Bitcoins for goods or services. As a result, several popular exchanges such as Poloniex and Kraken have placed a ban on users with IP addresses that originate from these states. You do not have to pay taxes on the Bitcoins themselves, and if you bought but never sold any within the year, you would have no tax liability. There are lots of reasons to trade crypto-to-crypto, one reason being some coins can only be bought using crypto. US Dollars or equivalent. And say you did this multiple times, you traded Ripple for Ether when Ripple is worth more Ether, then trade Ether for Ripple when Ether is worth more Ripples. Probably, but depends on your country. So we are registered in multiple locations and we have people in multiple locations. Given that no absolute information has been given, filing in good faith with detailed record-keeping will be evidence of your activity and your best attempt to report your taxes correctly. The tax law clearly lays out that this will no longer be an option. All this to say, you have until From there, as long as you are making enough to qualify as being self-employed and not mining as a hobby, you can deduct the cost of equipment and electricity, and then you pay taxes on the profit. Bitcoin is a personal property, not a currency, and so is taxed as a capital asset Gains made from converting Bitcoins into a fiat currency are subject to capital gains tax Purchases of goods or services with Bitcoins must also account for gains Bitcoins and other alt-coins obtained from mining is recognised income immediately at their fair value Mining equipment can still be deducted as a legitimate business expense Classification The IRS are treating Bitcoin as property. Good luck in the future with your trades and thanks again. Spreading awareness is the best way to strengthen our community. Tally up all your gains and losses, and you owe taxes on the profits at the marginal tax rate on dollars based on the brackets for the capital gains tax based on your income. Their fee is going to likely be worth it. This clear definition — one that made cryptocurrency akin to stocks and real estate — made bitcoins and alt-coins subject to capital gains taxes.

What happens if I earned Bitcoins? Hashflare Credit Card Btc Mining Time bought some bitcoin Difference Between Stocks And Cryptocurrency Mining Remove coinbase using my credit card. Ideally I would like the app to be able to trade in an out of any cryptocurrencies…. Take a moment to read this story, and realize that the guy made millions last year and lost it this January. If the amount goes up and down during the day? I believe you would just figure out your cost basis and then pay taxes on the sale of them when you trade or sell as a U. As Binance explains it:. Unfortunately this is all Bitcoin Exchange Zimbabwe Ethereum Coins Per Block complex that anyone who did any significant amount of trading really needs to see a tax professional. Every time you trade in and out of Ether and Ripple you have to tally gains and losses at Mine Litecoin On Bitmain Antminer C1 Why Did Neo Cryptocurrency Double point. You have to be trading a good amount in both volume and USD values for this to work. It is more complicated when Bitcoins are used to make a direct purchase. Trading cryptocurrency to cryptocurrency is a taxable event you have to calculate the fair market value in USD at the time of the trade; good luck with. Is it sufficient to bring that to a regular tax accountant and they will understand how to input that into my taxes? So more to calculate with crypto to crypto, but essentially all the same problems. The guy in the story was margin trading, so he was essentially dealing with USD. General Capital Gains Taxes Most countries consider Bitcoin and crypto-currencies as capital assets, and so any gains made are taxed like capital gains.

However, you are likely to be taxed when you sell or even spend those coins and make a profit. When you trade out of a coin it is effectively the same as selling for dollars and then quickly buying the new coin with those dollars. You would account for it here: Not the end of the world. In the second part of your question: If, say, the bitcoin bubble pops next year, taxpayers could still owe money to the IRS depending on gains or income achieved through trading during the year, swaps between digital assets, or hard forks. If it's considered as a tax event, then you are essentially exchanging Bitcoins for goods or services. As a result, several popular exchanges such as Poloniex and Kraken have placed a ban on users with IP addresses that originate from these states. You do not have to pay taxes on the Bitcoins themselves, and if you bought but never sold any within the year, you would have no tax liability. There are lots of reasons to trade crypto-to-crypto, one reason being some coins can only be bought using crypto. US Dollars or equivalent. And say you did this multiple times, you traded Ripple for Ether when Ripple is worth more Ether, then trade Ether for Ripple when Ether is worth more Ripples. Probably, but depends on your country. So we are registered in multiple locations and we have people in multiple locations. Given that no absolute information has been given, filing in good faith with detailed record-keeping will be evidence of your activity and your best attempt to report your taxes correctly. The tax law clearly lays out that this will no longer be an option. All this to say, you have until From there, as long as you are making enough to qualify as being self-employed and not mining as a hobby, you can deduct the cost of equipment and electricity, and then you pay taxes on the profit. Bitcoin is a personal property, not a currency, and so is taxed as a capital asset Gains made from converting Bitcoins into a fiat currency are subject to capital gains tax Purchases of goods or services with Bitcoins must also account for gains Bitcoins and other alt-coins obtained from mining is recognised income immediately at their fair value Mining equipment can still be deducted as a legitimate business expense Classification The IRS are treating Bitcoin as property. Good luck in the future with your trades and thanks again. Spreading awareness is the best way to strengthen our community. Tally up all your gains and losses, and you owe taxes on the profits at the marginal tax rate on dollars based on the brackets for the capital gains tax based on your income. Their fee is going to likely be worth it. This clear definition — one that made cryptocurrency akin to stocks and real estate — made bitcoins and alt-coins subject to capital gains taxes.