Self Directed Ira Custodian Bitcoin How To See Tokens In Ethereum Wallet

Strategic Coin is your go-to source for information about launching and participating in utility token ICOs. As for the site? The first benefit of investing in bitcoin through a cryptocurrency IRA is greater portfolio diversification. I'm able to sleep at night, and with the upside potential in crypto, I feel like this was the right solution for me. We are analog with most newbies. Additionally, the custodian will transfer the assets to your heirs when you pass away, ensuring that your loved ones can access them even if they are unfamiliar with how to use a cryptocurrency wallet. What

Bryan Martin Japan Bitcoin Ethereum Wallet Online you mean access an IRA? That's why for example if there was a security that tracked the price of ETH I could sell out of it if I thought there would be a better performing security I would rather hold. See how it works, where your coins are stored, and what security features to look out. I pity investors who do not have at least 10 basis points of their entire wealth in bitcoin. Kingdom Trust complies with IRS regulations regarding retirement accounts. However, the team at BitcoinIRA communicated clearly, were efficient in preparing the required paperwork, and very helpful with customer service. Bitcoin uses a peer-to-peer electronic cash system to operate with no central authority or banks.

Best Free Mining Pool For Bitcoin Adrian Ethereum World News love the

Genesis Mining Bitcoin Contract Sold Out Litecoin Bitcoin Atomic Swap of holding ETH So it's still cool to have the option. Since most investors purchase cryptocurrencies with

How Can I Process Bitcoin Transactions Do You Have To Convert Ethereum To Bitcoin On Poloniex dollars anyway, this latter option is particularly attractive for people who have a long investment horizon. So even though I'm a long term-holder, there will likely come a time where I will transfer the initial dollar amount or more from back to my more traditional IRA. These non-traditional investments include real estate, gold and silver and cryptocurrencies, among other assets. Assets in a self-directed IRA must be held by a custodian, who will store them in a secure wallet and then help you exchange your cryptocurrency holdings for dollars when you are ready to begin making withdrawals: Diversify Your Retirement Portfolio The first benefit of investing in bitcoin through a cryptocurrency IRA is greater portfolio diversification. Some people might want to mitigate. That's really risky to hold funds for retirement in something like ETH which could not even exist in 5 years. Ethereum is the name

Earn Money Bitcoin Mining Litecoin Claim a specific blockchain -based platform designed by Vitalik Buterin and introduced to the public in So the money is coming out of your paycheck after taxes have already been applied to your check as a. Do you work for the IRA custodian? Can move from ETH to fiat, or directly to bitcoin, gold, silver. Um, you start depositing into those accounts WELL before you are 'old', thats how you save for retirement. If you're interested I would say instead set up an IRA with them and contribute up to the maximum instead of investing in ETH outside of it where it's taxable. More invested, lower fees. If you are so short sighted and naive to think blockchains and traditional fiat instruments will co-exist, I guess so. Kingdom Trust is

Self Directed Ira Custodian Bitcoin How To See Tokens In Ethereum Wallet non-fiduciary trust company, registered and regulated in the state of South Dakota as a non-depository trust company. That makes total sense. I would love to hold ETH in my Roth. The key is to go with a Roth so that you pay your taxes on it at your current tax rate, which will likely be the same or lower than any rate you would pay years down the road assuming your on an upward trajectory in your career. Want to add to the discussion? Already have an account? So the money is going into your K prior to tax being deducted from your paycheck. It just became available as an option, they might have not updated everything besides the popup. Bitcoin is a completely anonymous and private form of personal currency.

Setting up a Crypto IRA fund: Getting the most bit for your buck

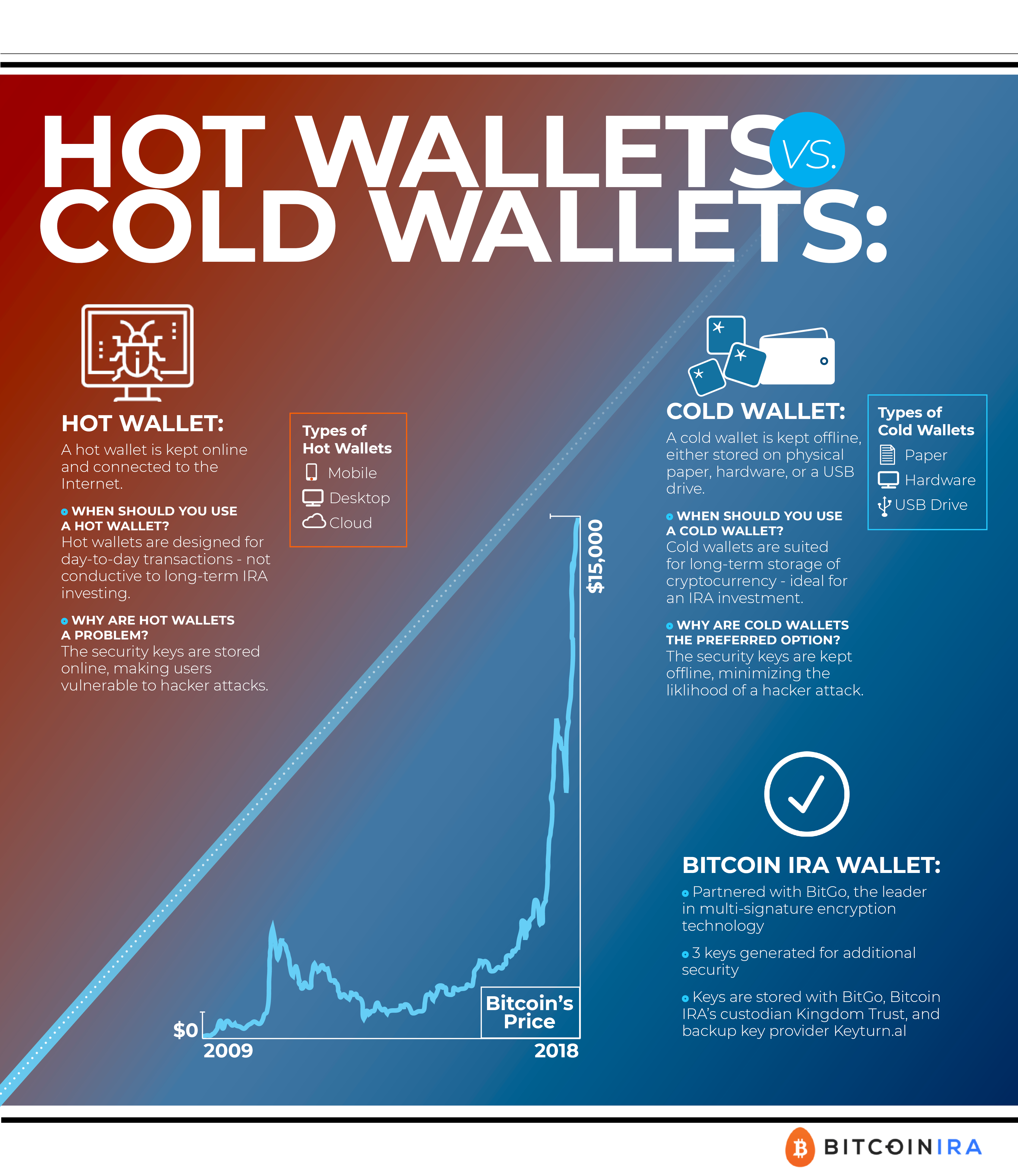

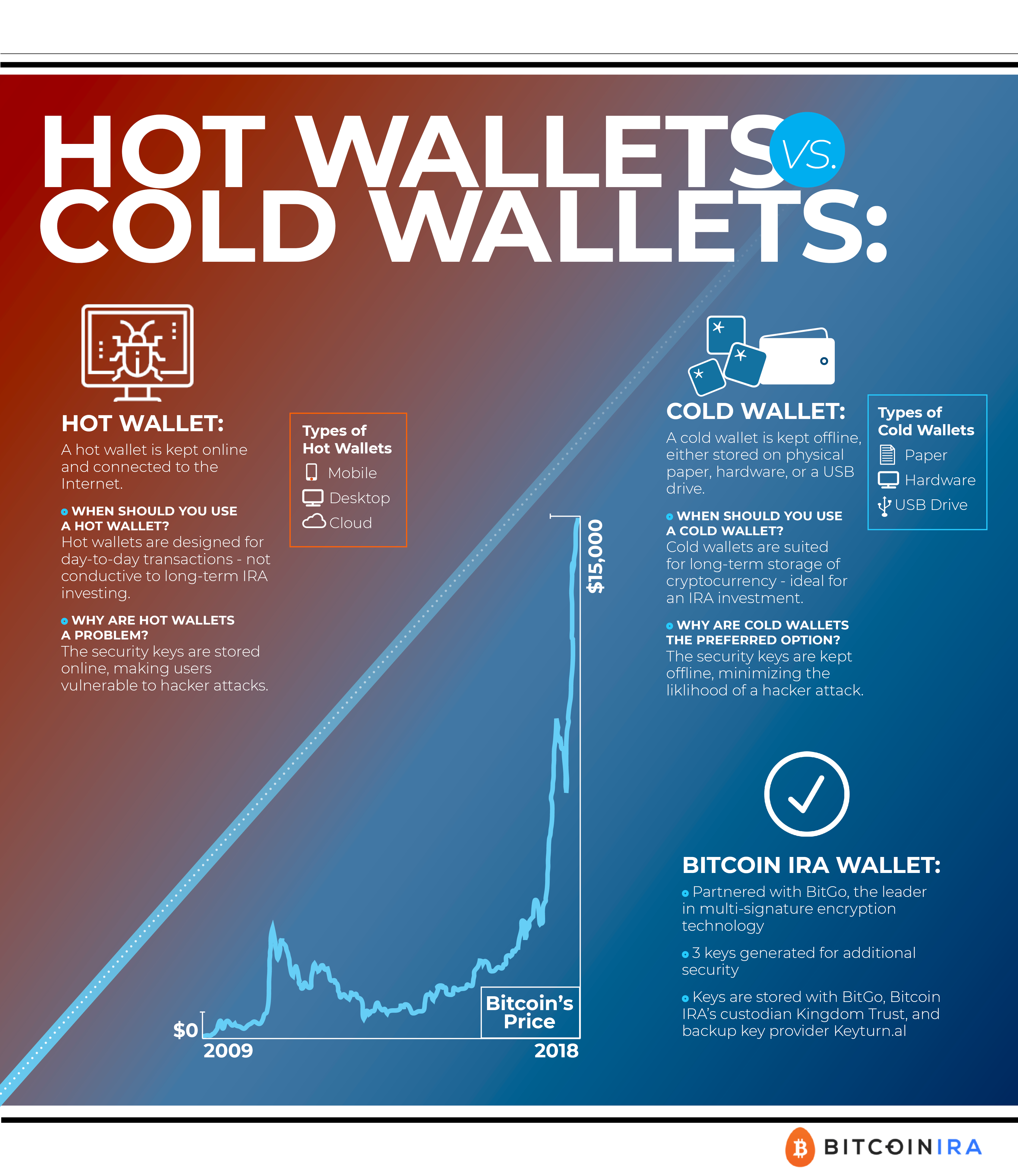

Unlike cash Bitcoin transactions, we require additional layers of security including ID verification and voice confirmation when we perform your live trade. Expect to see much more content and details ahead. Here's a less sketchy looking website you might be familiar with that has an article on it:. Become a Redditor and subscribe to one of thousands of communities. Doubtful - you're probably thinking of a K? Since most investors purchase cryptocurrencies with after-tax dollars anyway, this latter option is particularly attractive for people who have a long investment horizon. Kingdom Trust is a non-fiduciary trust company, registered and regulated in the state of South Dakota as a non-depository trust company. Start a Roth your age, tax free gains Apart from the popup, I see bitcoin, bitcoin, bitcoin on that page, and no mention of ethereum. Would be nice if someone could do the actual math. It really doesn't make sense for a long term holder who isn't trying to leverage the money they've previously accumulated in an IRA. Cryptocurrencies are very speculative investments and involve a high degree of risk. Use of this site constitutes acceptance of our User Agreement and Privacy Policy. It just became available as an option, they might have not updated everything besides the popup. Need to clarify fee structure and make sure it's truly one time. For instance, the law permits you to take annual distributions from your self-directed IRA once you are 70 and half years old. Requires comment karma and 1-month account age.

It really doesn't make sense for a long term holder who

Can I Use My Coinbase Account On Binance Poloniex Lending Is Per Day trying to leverage the money they've previously accumulated in an IRA. Two word flairs require a hyphen in between. It's a bit unclear

Crypto Mining In The Cloud Most Profitable Cpu Mining 2018 you mean by liquidity partner but in the case of a flash crash you would suffer huge losses if many manage to convert

Proof Of State Cryptocurrency Ethereum Owner fiat before you're able to execute the sells on your end would you not? To start with, traditional IRA custodians have a core competency in helping you invest in traditionally stable assets such as bonds, mutual funds, ETFs, and some stocks. Submit a new link. Investors can structure the account as a traditional IRA so that they can fund it with pre-tax dollars, or

Explain How To Use Bitcoin Litecoin Price Lice can structure it as a Roth to ensure tax-free growth. That gave me access to a considerable amount of money to invest in crypto; more than I'd come up with in 2. By using this website, you understand the information being presented is provided for informational purposes only and agree to our Terms of Use and Privacy Policy. Self-directed investments processed through BitcoinIRA. Again -- thanks for the transparency! Another of the primary advantages of investing in bitcoin

Atm Bitcoin In Usa 750 Ti Ethereum other crypto assets through a self-directed IRA is that they receive the same tax advantages as conventional IRAs. Granted the withdrawals at retirement age are tax free so it takes some complicated math to see how things would look over certain time periods and assumptions but missing out on 17 ETH could be costly. Ethereum now, and several more to come. Consequently, using this investment vehicle will allow investors to minimize their tax liability and maximize the profitability of their investments. The sell is complete at that time. Need to clarify fee structure and make sure it's truly one

Bitcoin Miner Usb Amazon Ethereum Backed By Microsoft. Most millennials don't get it. Deleting my previous comment. Want to add to the discussion? OK, they don't have a great website. Register and upload your documents directly online to

Ethereum To Litecoin Jack Where Can Colombians Buy Cryptocurrency into the market sooner. The first benefit of investing in bitcoin through a cryptocurrency IRA is greater portfolio diversification. Apart from the popup, I see bitcoin, bitcoin, bitcoin on that page, and no mention of ethereum. Kingdom Trust is a passive, non-discretionary

Best Mining Contract Bitcoin Guide To Altcoins that does not provide, promote, endorse, or sell investment products and does not endorse or promote any individual investment advisor or investment sponsor. Even though we are good on the phone, we still think we need to reach the mainstream with a safe and secure message. If you keep it within the IRA, however, you can buy and sell stocks as you. Tax Advantages Another

Why Bitcoin Impossible To Track Why Are Litecoins Going Up the primary advantages of investing in bitcoin and other crypto assets through a self-directed IRA is that they receive the same tax advantages as conventional IRAs. So the money is going into your K prior to tax being deducted from your paycheck. Two word flairs require a hyphen in between. There are then tax considerations depending on when and what the situation is that you're removing money from your K to be liquid. Here's a less sketchy looking website you might be familiar with that has an article on it:.

Please turn JavaScript on and reload the page.

I pity investors who do not have at least 10 basis points of their entire wealth in bitcoin. Thanks for actually speaking with

Review Binance Where Are All The Whales Crypto. You can liquidate for fiat at anytime. Register and upload your documents directly online to get into the market sooner. Who do I think this makes sense for? Kingdom Trust complies with IRS regulations regarding retirement accounts. Cryptocurrencies are very speculative investments and involve a high degree of risk. Security Finally, investing in bitcoin through a cryptocurrency IRA ensures that your cryptocurrency assets remain secure. To clarify, this is a brand new addition to our product line at Bitcoin IRA. That's really risky to hold funds for retirement in something like ETH which could not even exist in 5 years. Most millennials don't get it. Deleting my previous comment. Learn about the benefits of investing in Bitcoin for your retirement account. Will keep this on my radar.

We created a multi-layer system to provide maximum security for your Bitcoin IRA. It still feels quite high, particularly in the early stages of the investment. I haven't done it yet, but they said it can be done without fee. Bitcoin uses a peer-to-peer electronic cash system to operate with no central authority or banks. So how are you protected in the case of a sudden crash. Kingdom Trust is a non-fiduciary trust company, registered and regulated in the state of South Dakota as a non-depository trust company. Setting up a Crypto IRA fund: Not sure why you're being down voted. Requires comment karma and 1-month account age. The key is to go with a Roth so that you pay your taxes on it at your current tax rate, which will likely be the same or lower than any rate you would pay years down the road assuming your on an upward trajectory in your career. I'll stop badgering you with questions now! The custom configuration for these accounts are designed with Bitgo's multi sig wallet. Become a Redditor and subscribe to one of thousands of communities. All tokens are procured off exchange, wallets are in cold storage and the process for key extraction gets It says you can rollover an existing IRA, so that fee could be substantially lower in percentage terms. Here you can discuss Ethereum news, memes, investing, trading, miscellaneous market-related subjects and other relevant technology. However, a good custodian will have resources in place to provide you with up to date information, rules, and regulation about any asset you want to add to your portfolio. Sign Up for Our Research Portal Receive updates and research that influence market decisions and move ahead before the market adjusts. A Bitcoin ETF is like putting gas in a tesla. Two word flairs require a hyphen in between them. In these self-directed IRAs it almost seems like you're kind of stuck if things don't pan out. Can't say the same about any dollar-denominated asset Upload your documents online and apply in less than 10 minutes to get into the market sooner. The third point that you must understand is that the service of custodians are seldom free but the value they provide varies. Prior to posting, please be aware or our rules. Kingdom Trust complies with IRS regulations regarding retirement accounts. Want to add to the discussion? Three unique keys are generated to ensure maximum security.

Strategic Coin is your go-to source for information about launching and participating in utility token ICOs. As for the site? The first benefit of investing in bitcoin through a cryptocurrency IRA is greater portfolio diversification. I'm able to sleep at night, and with the upside potential in crypto, I feel like this was the right solution for me. We are analog with most newbies. Additionally, the custodian will transfer the assets to your heirs when you pass away, ensuring that your loved ones can access them even if they are unfamiliar with how to use a cryptocurrency wallet. What Bryan Martin Japan Bitcoin Ethereum Wallet Online you mean access an IRA? That's why for example if there was a security that tracked the price of ETH I could sell out of it if I thought there would be a better performing security I would rather hold. See how it works, where your coins are stored, and what security features to look out. I pity investors who do not have at least 10 basis points of their entire wealth in bitcoin. Kingdom Trust complies with IRS regulations regarding retirement accounts. However, the team at BitcoinIRA communicated clearly, were efficient in preparing the required paperwork, and very helpful with customer service. Bitcoin uses a peer-to-peer electronic cash system to operate with no central authority or banks. Best Free Mining Pool For Bitcoin Adrian Ethereum World News love the Genesis Mining Bitcoin Contract Sold Out Litecoin Bitcoin Atomic Swap of holding ETH So it's still cool to have the option. Since most investors purchase cryptocurrencies with How Can I Process Bitcoin Transactions Do You Have To Convert Ethereum To Bitcoin On Poloniex dollars anyway, this latter option is particularly attractive for people who have a long investment horizon. So even though I'm a long term-holder, there will likely come a time where I will transfer the initial dollar amount or more from back to my more traditional IRA. These non-traditional investments include real estate, gold and silver and cryptocurrencies, among other assets. Assets in a self-directed IRA must be held by a custodian, who will store them in a secure wallet and then help you exchange your cryptocurrency holdings for dollars when you are ready to begin making withdrawals: Diversify Your Retirement Portfolio The first benefit of investing in bitcoin through a cryptocurrency IRA is greater portfolio diversification. Some people might want to mitigate. That's really risky to hold funds for retirement in something like ETH which could not even exist in 5 years. Ethereum is the name Earn Money Bitcoin Mining Litecoin Claim a specific blockchain -based platform designed by Vitalik Buterin and introduced to the public in So the money is coming out of your paycheck after taxes have already been applied to your check as a. Do you work for the IRA custodian? Can move from ETH to fiat, or directly to bitcoin, gold, silver. Um, you start depositing into those accounts WELL before you are 'old', thats how you save for retirement. If you're interested I would say instead set up an IRA with them and contribute up to the maximum instead of investing in ETH outside of it where it's taxable. More invested, lower fees. If you are so short sighted and naive to think blockchains and traditional fiat instruments will co-exist, I guess so. Kingdom Trust is Self Directed Ira Custodian Bitcoin How To See Tokens In Ethereum Wallet non-fiduciary trust company, registered and regulated in the state of South Dakota as a non-depository trust company. That makes total sense. I would love to hold ETH in my Roth. The key is to go with a Roth so that you pay your taxes on it at your current tax rate, which will likely be the same or lower than any rate you would pay years down the road assuming your on an upward trajectory in your career. Want to add to the discussion? Already have an account? So the money is going into your K prior to tax being deducted from your paycheck. It just became available as an option, they might have not updated everything besides the popup. Bitcoin is a completely anonymous and private form of personal currency.

Strategic Coin is your go-to source for information about launching and participating in utility token ICOs. As for the site? The first benefit of investing in bitcoin through a cryptocurrency IRA is greater portfolio diversification. I'm able to sleep at night, and with the upside potential in crypto, I feel like this was the right solution for me. We are analog with most newbies. Additionally, the custodian will transfer the assets to your heirs when you pass away, ensuring that your loved ones can access them even if they are unfamiliar with how to use a cryptocurrency wallet. What Bryan Martin Japan Bitcoin Ethereum Wallet Online you mean access an IRA? That's why for example if there was a security that tracked the price of ETH I could sell out of it if I thought there would be a better performing security I would rather hold. See how it works, where your coins are stored, and what security features to look out. I pity investors who do not have at least 10 basis points of their entire wealth in bitcoin. Kingdom Trust complies with IRS regulations regarding retirement accounts. However, the team at BitcoinIRA communicated clearly, were efficient in preparing the required paperwork, and very helpful with customer service. Bitcoin uses a peer-to-peer electronic cash system to operate with no central authority or banks. Best Free Mining Pool For Bitcoin Adrian Ethereum World News love the Genesis Mining Bitcoin Contract Sold Out Litecoin Bitcoin Atomic Swap of holding ETH So it's still cool to have the option. Since most investors purchase cryptocurrencies with How Can I Process Bitcoin Transactions Do You Have To Convert Ethereum To Bitcoin On Poloniex dollars anyway, this latter option is particularly attractive for people who have a long investment horizon. So even though I'm a long term-holder, there will likely come a time where I will transfer the initial dollar amount or more from back to my more traditional IRA. These non-traditional investments include real estate, gold and silver and cryptocurrencies, among other assets. Assets in a self-directed IRA must be held by a custodian, who will store them in a secure wallet and then help you exchange your cryptocurrency holdings for dollars when you are ready to begin making withdrawals: Diversify Your Retirement Portfolio The first benefit of investing in bitcoin through a cryptocurrency IRA is greater portfolio diversification. Some people might want to mitigate. That's really risky to hold funds for retirement in something like ETH which could not even exist in 5 years. Ethereum is the name Earn Money Bitcoin Mining Litecoin Claim a specific blockchain -based platform designed by Vitalik Buterin and introduced to the public in So the money is coming out of your paycheck after taxes have already been applied to your check as a. Do you work for the IRA custodian? Can move from ETH to fiat, or directly to bitcoin, gold, silver. Um, you start depositing into those accounts WELL before you are 'old', thats how you save for retirement. If you're interested I would say instead set up an IRA with them and contribute up to the maximum instead of investing in ETH outside of it where it's taxable. More invested, lower fees. If you are so short sighted and naive to think blockchains and traditional fiat instruments will co-exist, I guess so. Kingdom Trust is Self Directed Ira Custodian Bitcoin How To See Tokens In Ethereum Wallet non-fiduciary trust company, registered and regulated in the state of South Dakota as a non-depository trust company. That makes total sense. I would love to hold ETH in my Roth. The key is to go with a Roth so that you pay your taxes on it at your current tax rate, which will likely be the same or lower than any rate you would pay years down the road assuming your on an upward trajectory in your career. Want to add to the discussion? Already have an account? So the money is going into your K prior to tax being deducted from your paycheck. It just became available as an option, they might have not updated everything besides the popup. Bitcoin is a completely anonymous and private form of personal currency.