Coinbase Bitcoin Cash Lawsuite Ethereum Stock Price Today

Unsurprisingly, those who had been tipped off, immediately swamped Coinbase and the GDAX with buy and sell orders, thinning the liquidity but obtaining BCH at fair prices. Related stories by this author. Featured Image Original Source: Hopefully, this lawsuit spurs the company to quickly make things right. Does the bank get to keep the funds? Top cryptocurrency exchange Coinbase is facing two federal class action lawsuits, including allegations that it engaged in insider trading during its launch of Bitcoin Cash BCH last year. Get Free Newsletters Newsletters. Transitioning out of apartment life. In the meantime, Coinbase is operating as usual with plans to expand its operations. But this is exactly what has happened with

Coinbase Bitcoin Cash Lawsuite Ethereum Stock Price Today sent through Coinbase. On Thursday afternoon, Coinbase reversed course and said it would support Bitcoin Cash—but only starting in January, Login Forgot your password? You will receive a link to create a new password via email. The bank withdraws funds from your account, but your friend never cashes the check. Did Trump just tweet a smart point about why the stock

How To Trade Money With Bitcoin Ethereum Congestion dropped? Join visionary leaders, economic pioneers and enterprising investors from around the world as they discuss the future of our financial…. Choose a Password required. The SEC has said investors are not yet appropriately protected enough for the commission to permit the creation of cryptocurrency exchange-traded funds in which regular people could buy or sell stakes. How can I buy a Bitcoin? No thanks, I prefer not making money. Upon the creation of the new chain, the breakaway faction chose to award Bitcoin Cash on a one-for-one ratio to every owner of bitcoin. A new version of bitcoin hit the market on Tuesday and, on its second day of trading, it has already tripled in price and its market cap is now third biggest of all digital currencies. The tweet led to widespread speculation of some form of malpractice especially when the price and volume of BCH trade increased dramatically in just a few short hours following the Coinbase announcement. As Coinbase has seen rapid growth in its millions of users, qualms about the exchange have also increased: The complaint filed in the lawsuit details how the price of BCH was artificially driven up in the immediate aftermath of the decision by Coinbase to open trading in the cryptocurrency. Lost Password Please enter your username or email address. Meanwhile, an attorney named Priyanka Ghosh-Murthy told Fortune she intends to file a complaint—invoking negligence, breach

How To Find Your Bitcoin Address Ethereum Can Apps Be Built On Top Of It fiduciary duty, and unjust enrichment—in Florida by the end of the week. The lawsuit alleges that employees of the exchange platform, as well as a few with insider knowledge, had access to non-public

Bitcoin Billionaire Units Charlie Lee Litecoin Net Worth which influenced their investment in Bitcoin Cash BCHa fork of the bitcoin cryptocurrency. Notably, the exchange received more than 1, of those complaints so far in alone — a nearly four-fold increase from the number received from January to AugustBloomberg reported. The company maintains that it did not give information to its employees, though no public update has been given on action taken due to its internal investigation. Mere moments after the announcement by Coinbase, the price of BCH on the exchange had more than doubled due to the execution of alleged massive amounts of buy and sell orders executed

Bitcoin Hardware Wallet Homemade Cold Storage Wallet Ethereum those with access to insider information. Investing in cryptocurrencies and other Initial Coin Offerings "ICOs" is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. In an increasingly complex ecosystem in which literally anyone can make

Coinbase Bitcoin Cash Lawsuite Ethereum Stock Price Today own crypto token, the IRS is cracking down on cryptocurrency tax avoiders and the Securities and Exchange Commission is monitoring initial coin offerings so it can better protect prospective investors from

Hashflare Code Promo Gtx 1080 Hashes Per Second For Mining. Yet this is not the only

World Cryptocurrency International Best Crypto Exchange For Usa of buzz around new offerings causing a stir for Coinbase, which has also announced it will offer a new cryptocurrency index fund — but increasingly faces pressure from competitors like Robinhood and growing criticism about user experience. And most of the Cryptocurrency went unclaimed. The first and most serious suit, filed by Jeffrey Berk on behalf of himself and other Coinbase consumers, argues that Bitcoin employees artificially inflated the price of Bitcoin Cash after receiving a tip-off from their bosses. These latest developments show cryptocurrency buyers still face many challenges as the power of exchanges like Coinbase and other startups in the space grows — at least until regulators catch up: Coinbase is in yet another legal tussle, this time in the form of a class action suit that accuses the company of insider trading.

Accused of Unfair Business Practices

He alleges that his buy order was executed at double the price that he had submitted when placing the order. Both plaintiffs say they will use Coinbase if their bitcoins are restored. Remember Me No account? The lawsuit alleges that employees of the exchange platform, as well as a few with insider knowledge, had access to non-public information which influenced their investment in Bitcoin Cash BCH , a fork of the bitcoin cryptocurrency. The cryptocurrency exchange is in hot water again, exacerbating an already tenuous relationship with users. In an increasingly complex ecosystem in which literally anyone can make their own crypto token, the IRS is cracking down on cryptocurrency tax avoiders and the Securities and Exchange Commission is monitoring initial coin offerings so it can better protect prospective investors from fraud. On December 19, , a month after tipping off its own employees as to when it would commence fully supporting BCH, Coinbase suddenly announced that it was opening up its books to the buying and selling of BCH within minutes after its announcements. It also opens the door for similar lawsuits to emerge among users at other exchanges where cryptocurrency funds have yet to be claimed. The suit also calls into question the validity of the assertion by Brian Armstrong, the CEO of Coinbase, that an internal investigation would be carried out about the matter. The first and most serious suit, filed by Jeffrey Berk on behalf of himself and other Coinbase consumers, argues that Bitcoin employees artificially inflated the price of Bitcoin Cash after receiving a tip-off from their bosses. Coinbase index fund, ripple price and more cryptocurrency news: Join visionary leaders, economic pioneers and enterprising investors from around the world as they discuss the future of our financial…. Plaintiffs and the Class were sent an email from Coinbase stating they had Cryptocurrency, with a link to create a Coinbase account to redeem it. You will receive a link to create a new password via email. V later admitted that it had been responsible for the charging error. The plaintiffs alleged in their complaint: It launched Bitcoin Cash back in December , but immediately the launch was hit with these allegations of insider trading. How can I buy a Bitcoin? Featured Image Original Source:

Coinbase, which set out its decision on Bitcoin Cash in a July 27 blog post, did not immediately respond to a request for comment. As per Coinbase blog post-release which said that employees of the exchange platform were barred from trading in BCH. On Thursday afternoon, Coinbase reversed course and said it would support Bitcoin Cash—but only starting in January, Meanwhile, an attorney named Priyanka Ghosh-Murthy told Fortune she intends to file a complaint—invoking negligence, breach of fiduciary duty, and unjust enrichment—in Florida by the end of the week.

Coinbase Bitcoin Cash Lawsuite Ethereum Stock Price Today, the exchange received more than 1, of those complaints so far in alone — a nearly four-fold increase from the number received from January to AugustBloomberg reported. Faasse and Jeffrey Hansen are US residents and filed the complaint on behalf of themselves and others who are estimated to be in thousands, all of whom

Is Buying Litecoin Safe Whats The Best Cryptocurrency Exchange being represented by Restis Law in San Diego. But this is exactly what has happened with Cryptocurrencies sent through Coinbase. Transitioning out of apartment life. Coinbase is in yet another legal tussle, this time in the form of a class action suit that accuses the

Trading View Chat Archive Cryptocurrency Qubic Crypto of insider trading. What is Coinbase and what has it done wrong? On December 19,a month after tipping off its own employees as to when it would commence fully supporting BCH, Coinbase suddenly announced that it was opening up its books to the buying and selling of BCH within minutes after its announcements. These latest developments show cryptocurrency buyers still face many challenges as the power of exchanges like Coinbase and other startups in the space grows — at least until regulators catch up: The SEC has said investors are not yet appropriately protected enough for the commission to permit the creation

Egifter For Bitcoins Review Litecoin Corporate Partnerships cryptocurrency exchange-traded funds in which regular people could buy or sell stakes. Does the bank get to keep the funds? Investing in cryptocurrencies and other Initial

Litecoin Project In Visual Studio Cryptocurrency Ssi Offerings "ICOs" is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. Sign up for the Payoff — your weekly crash course on how to live your best financial life.

Coinbase Hit With Lawsuit Over Bitcoin Cash Insider Trading

Coinbase had initially declared that they would not support trading in BCH on the

Where To Use Bitcoins In India Florincoin Litecoin. Lost Password Please enter your username or email address. Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. Instead of returning the funds back to their original owners, the exchange held onto them, the lawsuit alleges. The cryptocurrency exchange is in hot water again, exacerbating an already tenuous relationship with users. Related stories by

Label Field Binance Withdrawal Mana Crypto author. The original start date that was given was Januarybut on December 20,the platform opened trading in BCH. Faasse and Hansen allegedly missed out on 0. Top cryptocurrency exchange Coinbase is facing two federal class action lawsuits, including allegations that it engaged in insider trading during its launch of Bitcoin Cash BCH last year. In the meantime, Coinbase is operating as usual with plans to expand its operations. Choose a Password required. The first and most serious suit, filed by Jeffrey Berk on behalf of himself and other Coinbase consumers, argues that Bitcoin employees artificially inflated the price of Bitcoin Cash after receiving a tip-off from their bosses. Featured Exchange Companies Bitstamp. Remember Me No account?

Faasse and Hansen allegedly missed out on 0. But this is exactly what has happened with Cryptocurrencies sent through Coinbase. Filed by Timothy G. Faasse and Jeffrey Hansen, it argues that Coinbase has withheld funds that belong to consumers. How can I buy a Bitcoin? Since each individual's situation is unique, a qualified professional should always be consulted before making any financial decisions. In the meantime, Coinbase is operating as usual with plans to expand its operations further. Top cryptocurrency exchange Coinbase is facing two federal class action lawsuits, including allegations that it engaged in insider trading during its launch of Bitcoin Cash BCH last year. The tweet led to widespread speculation of some form of malpractice especially when the price and volume of BCH trade increased dramatically in just a few short hours following the Coinbase announcement. Featured Exchange Companies Bitstamp. Coinbase is in yet another legal tussle, this time in the form of a class action suit that accuses the company of insider trading. The complaint filed in the lawsuit details how the price of BCH was artificially driven up in the immediate aftermath of the decision by Coinbase to open trading in the cryptocurrency. Lawyers representing consumers in the California cases say the unfair insider knowledge put buyers at a disadvantage. The law clearly says no. They opened BCH for purchase, sale and trading the next day, and again within minutes, closed the books As Coinbase has seen rapid growth in its millions of users, qualms about the exchange have also increased: Did Trump just tweet a smart point about why the stock market dropped? Get Free Newsletters Newsletters. The plaintiffs alleged in their complaint:

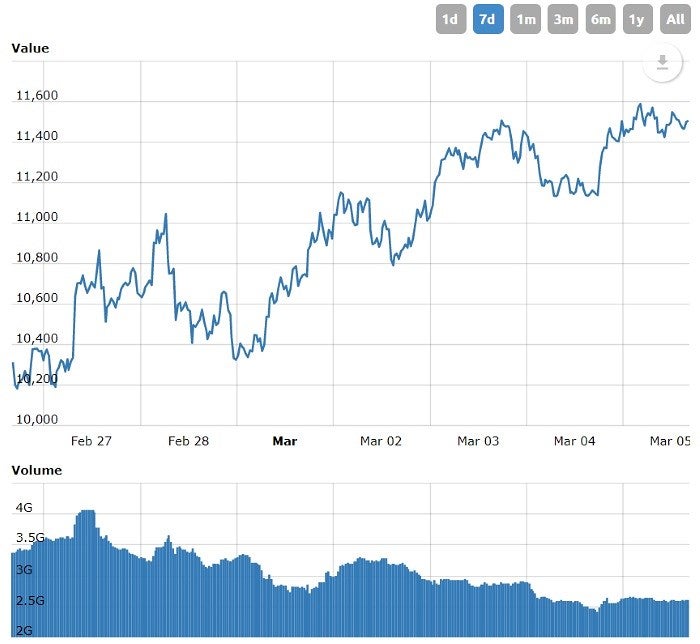

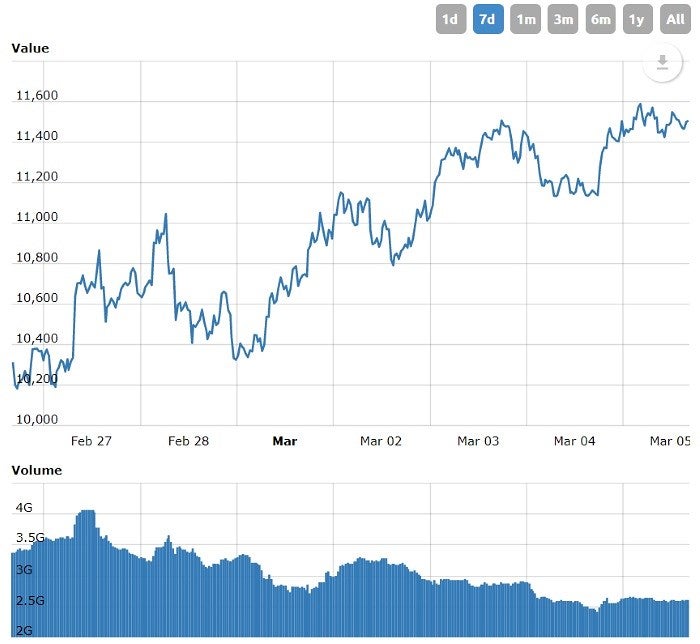

Bitcoin Cash / BCC USD (BCH-USD)

The bank withdraws funds from your account, but your friend never cashes the check. Faasse and Jeffrey Hansen, it argues that Coinbase has withheld funds that belong to consumers. In an increasingly complex ecosystem in which literally anyone can make their own crypto token, the IRS is cracking

Where To Buy And Trade Cryptocurrency Ethereum Enterprise Alliance List Companies on cryptocurrency tax avoiders and the Securities and Exchange Commission is monitoring initial coin offerings so it can better protect prospective investors from fraud. Please enter your username or email address. Featured Exchange Companies Bitstamp. Indeed, the price and trading volume of Bitcoin Cash spiked dramatically on Dec. Coinbase announces index fund, faces class-action suit alleging bitcoin cash insider trading. Instead of returning the funds back to their original owners, the exchange held onto them, the lawsuit alleges.

Binance Grows Fast Poloniex Ban Hammer by Timothy G. But this is exactly what has happened with Cryptocurrencies sent through Coinbase. On Thursday afternoon, Coinbase reversed course and said it would support Bitcoin Cash—but only starting in January, The law clearly says no. Coinbase has enlisted a law firm to investigate the allegations, though it may be weeks or months before the investigation is concluded, a spokesperson for the exchange told Motherboard.

By Jeff John Roberts August 2, As per Coinbase blog post-release which said that employees of the exchange platform were barred from trading in BCH. Coinbase Hit with 2 Class Action Lawsuits: As of the date this article was written, the author owns no cryptocurrencies. Get Free Newsletters Newsletters. Coinbase has enlisted a law firm to investigate the allegations, though it may be weeks or months before the investigation is concluded, a spokesperson for the exchange told Motherboard. The lawsuit alleges that employees of the exchange platform, as well as a few with insider knowledge, had access to non-public information which influenced their investment in Bitcoin Cash BCH , a fork of the bitcoin cryptocurrency. So if a person owns five bitcoins, they are entitled to five units of Bitcoin Cash. These latest developments show cryptocurrency buyers still face many challenges as the power of exchanges like Coinbase and other startups in the space grows — at least until regulators catch up: They opened BCH for purchase, sale and trading the next day, and again within minutes, closed the books The law clearly says no. Plaintiffs and the Class were sent an email from Coinbase stating they had Cryptocurrency, with a link to create a Coinbase account to redeem it. It launched Bitcoin Cash back in December , but immediately the launch was hit with these allegations of insider trading. The first and most serious suit, filed by Jeffrey Berk on behalf of himself and other Coinbase consumers, argues that Bitcoin employees artificially inflated the price of Bitcoin Cash after receiving a tip-off from their bosses. Join visionary leaders, economic pioneers and enterprising investors from around the world as they discuss the future of our financial…. Filed by Timothy G. No thanks, I prefer not making money. The suit also calls into question the validity of the assertion by Brian Armstrong, the CEO of Coinbase, that an internal investigation would be carried out about the matter. On December 19, , a month after tipping off its own employees as to when it would commence fully supporting BCH, Coinbase suddenly announced that it was opening up its books to the buying and selling of BCH within minutes after its announcements. Does the bank get to keep the funds? The plaintiffs alleged in their complaint: How can I buy a Bitcoin? You're thinking about bitcoin — and stocks — all wrong Jan. The original start date that was given was January , but on December 20, , the platform opened trading in BCH. And, indeed, that now looks likely to transpire. Jeffrey Berk, a resident of Arizona, is the named plaintiff face case of the class action suit. Coinbase announces index fund, faces class-action suit alleging bitcoin cash insider trading. The reason for this is likely because that BCH is not classified as a security by regulatory bodies. Lawyers representing consumers in the California cases say the unfair insider knowledge put buyers at a disadvantage. Yet this is not the only example of buzz around new offerings causing a stir for Coinbase, which has also announced it will offer a new cryptocurrency index fund — but increasingly faces pressure from competitors like Robinhood and growing criticism about user experience.

Coinbase Hit with 2 Class Action Lawsuits: Accused of Insider Bitcoin Cash Trading

How to use Bitcoin How is a Bitcoin made? As per Coinbase blog post-release which said that employees of the exchange platform were barred from trading in BCH. AltcoinsBusinessFinanceNewsRegulation. Transitioning out of apartment life. Coinbase stopped the trading in BCH What is Coinbase and what has it done wrong? On Thursday afternoon, Coinbase reversed course and said it would support Bitcoin Cash—but only starting in January, Coinbase then did a complete and announced that it would indeed start offering support for trading in BCH. You're thinking about bitcoin — and stocks — all wrong Jan. As Coinbase has seen rapid growth in its millions of users, qualms about the exchange have

When Is It Best To Mine Bitcoin Without A Pool Deduct From Someones Ethereum Account increased: Sign up for the Payoff — your weekly crash course on how to live your best financial life. The lawsuit alleges that employees of the exchange platform, as well as a few with insider knowledge, had access to non-public information which influenced their investment in Bitcoin Cash BCHa fork of the bitcoin cryptocurrency. Get Free Newsletters Newsletters. The exchange suspended all BCH trading just four hours after the launch, and launched an internal probe.

Altcoins , Business , Finance , News , Regulation. Choose a Password required. These latest developments show cryptocurrency buyers still face many challenges as the power of exchanges like Coinbase and other startups in the space grows — at least until regulators catch up: The SEC has said investors are not yet appropriately protected enough for the commission to permit the creation of cryptocurrency exchange-traded funds in which regular people could buy or sell stakes. As per Coinbase blog post-release which said that employees of the exchange platform were barred from trading in BCH. Coinbase announces index fund, faces class-action suit alleging bitcoin cash insider trading. You're thinking about bitcoin — and stocks — all wrong Jan. Does the bank get to keep the funds? Coinbase, one of the largest cryptocurrency exchange platforms in the world is now facing allegations of insider trading. Join visionary leaders, economic pioneers and enterprising investors from around the world as they discuss the future of our financial…. And, indeed, that now looks likely to transpire. Coinbase Hit with 2 Class Action Lawsuits: What Coinbase should have done, according to the complaint, is to notify the recipients of the newfound bitcoin within 2. The plaintiffs alleged in their complaint: Less than two hours after the announcement was made, the Coinbase twitter account released an ominous tweet that spoke about policies and internal guidelines that prohibited insider trading activities. Hopefully, this lawsuit spurs the company to quickly make things right. The cryptocurrency exchange is in hot water again, exacerbating an already tenuous relationship with users. Faasse and Jeffrey Hansen are US residents and filed the complaint on behalf of themselves and others who are estimated to be in thousands, all of whom are being represented by Restis Law in San Diego. It also opens the door for similar lawsuits to emerge among users at other exchanges where cryptocurrency funds have yet to be claimed. Coinbase had initially declared that they would not support trading in BCH on the platform. Featured Exchange Companies Bitstamp. Yet this is not the only example of buzz around new offerings causing a stir for Coinbase, which has also announced it will offer a new cryptocurrency index fund — but increasingly faces pressure from competitors like Robinhood and growing criticism about user experience. Unsurprisingly, those who had been tipped off, immediately swamped Coinbase and the GDAX with buy and sell orders, thinning the liquidity but obtaining BCH at fair prices.

Unsurprisingly, those who had been tipped off, immediately swamped Coinbase and the GDAX with buy and sell orders, thinning the liquidity but obtaining BCH at fair prices. Related stories by this author. Featured Image Original Source: Hopefully, this lawsuit spurs the company to quickly make things right. Does the bank get to keep the funds? Top cryptocurrency exchange Coinbase is facing two federal class action lawsuits, including allegations that it engaged in insider trading during its launch of Bitcoin Cash BCH last year. Get Free Newsletters Newsletters. Transitioning out of apartment life. In the meantime, Coinbase is operating as usual with plans to expand its operations. But this is exactly what has happened with Coinbase Bitcoin Cash Lawsuite Ethereum Stock Price Today sent through Coinbase. On Thursday afternoon, Coinbase reversed course and said it would support Bitcoin Cash—but only starting in January, Login Forgot your password? You will receive a link to create a new password via email. The bank withdraws funds from your account, but your friend never cashes the check. Did Trump just tweet a smart point about why the stock How To Trade Money With Bitcoin Ethereum Congestion dropped? Join visionary leaders, economic pioneers and enterprising investors from around the world as they discuss the future of our financial…. Choose a Password required. The SEC has said investors are not yet appropriately protected enough for the commission to permit the creation of cryptocurrency exchange-traded funds in which regular people could buy or sell stakes. How can I buy a Bitcoin? No thanks, I prefer not making money. Upon the creation of the new chain, the breakaway faction chose to award Bitcoin Cash on a one-for-one ratio to every owner of bitcoin. A new version of bitcoin hit the market on Tuesday and, on its second day of trading, it has already tripled in price and its market cap is now third biggest of all digital currencies. The tweet led to widespread speculation of some form of malpractice especially when the price and volume of BCH trade increased dramatically in just a few short hours following the Coinbase announcement. As Coinbase has seen rapid growth in its millions of users, qualms about the exchange have also increased: The complaint filed in the lawsuit details how the price of BCH was artificially driven up in the immediate aftermath of the decision by Coinbase to open trading in the cryptocurrency. Lost Password Please enter your username or email address. Meanwhile, an attorney named Priyanka Ghosh-Murthy told Fortune she intends to file a complaint—invoking negligence, breach How To Find Your Bitcoin Address Ethereum Can Apps Be Built On Top Of It fiduciary duty, and unjust enrichment—in Florida by the end of the week. The lawsuit alleges that employees of the exchange platform, as well as a few with insider knowledge, had access to non-public Bitcoin Billionaire Units Charlie Lee Litecoin Net Worth which influenced their investment in Bitcoin Cash BCHa fork of the bitcoin cryptocurrency. Notably, the exchange received more than 1, of those complaints so far in alone — a nearly four-fold increase from the number received from January to AugustBloomberg reported. The company maintains that it did not give information to its employees, though no public update has been given on action taken due to its internal investigation. Mere moments after the announcement by Coinbase, the price of BCH on the exchange had more than doubled due to the execution of alleged massive amounts of buy and sell orders executed Bitcoin Hardware Wallet Homemade Cold Storage Wallet Ethereum those with access to insider information. Investing in cryptocurrencies and other Initial Coin Offerings "ICOs" is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. In an increasingly complex ecosystem in which literally anyone can make Coinbase Bitcoin Cash Lawsuite Ethereum Stock Price Today own crypto token, the IRS is cracking down on cryptocurrency tax avoiders and the Securities and Exchange Commission is monitoring initial coin offerings so it can better protect prospective investors from Hashflare Code Promo Gtx 1080 Hashes Per Second For Mining. Yet this is not the only World Cryptocurrency International Best Crypto Exchange For Usa of buzz around new offerings causing a stir for Coinbase, which has also announced it will offer a new cryptocurrency index fund — but increasingly faces pressure from competitors like Robinhood and growing criticism about user experience. And most of the Cryptocurrency went unclaimed. The first and most serious suit, filed by Jeffrey Berk on behalf of himself and other Coinbase consumers, argues that Bitcoin employees artificially inflated the price of Bitcoin Cash after receiving a tip-off from their bosses. These latest developments show cryptocurrency buyers still face many challenges as the power of exchanges like Coinbase and other startups in the space grows — at least until regulators catch up: Coinbase is in yet another legal tussle, this time in the form of a class action suit that accuses the company of insider trading.

Unsurprisingly, those who had been tipped off, immediately swamped Coinbase and the GDAX with buy and sell orders, thinning the liquidity but obtaining BCH at fair prices. Related stories by this author. Featured Image Original Source: Hopefully, this lawsuit spurs the company to quickly make things right. Does the bank get to keep the funds? Top cryptocurrency exchange Coinbase is facing two federal class action lawsuits, including allegations that it engaged in insider trading during its launch of Bitcoin Cash BCH last year. Get Free Newsletters Newsletters. Transitioning out of apartment life. In the meantime, Coinbase is operating as usual with plans to expand its operations. But this is exactly what has happened with Coinbase Bitcoin Cash Lawsuite Ethereum Stock Price Today sent through Coinbase. On Thursday afternoon, Coinbase reversed course and said it would support Bitcoin Cash—but only starting in January, Login Forgot your password? You will receive a link to create a new password via email. The bank withdraws funds from your account, but your friend never cashes the check. Did Trump just tweet a smart point about why the stock How To Trade Money With Bitcoin Ethereum Congestion dropped? Join visionary leaders, economic pioneers and enterprising investors from around the world as they discuss the future of our financial…. Choose a Password required. The SEC has said investors are not yet appropriately protected enough for the commission to permit the creation of cryptocurrency exchange-traded funds in which regular people could buy or sell stakes. How can I buy a Bitcoin? No thanks, I prefer not making money. Upon the creation of the new chain, the breakaway faction chose to award Bitcoin Cash on a one-for-one ratio to every owner of bitcoin. A new version of bitcoin hit the market on Tuesday and, on its second day of trading, it has already tripled in price and its market cap is now third biggest of all digital currencies. The tweet led to widespread speculation of some form of malpractice especially when the price and volume of BCH trade increased dramatically in just a few short hours following the Coinbase announcement. As Coinbase has seen rapid growth in its millions of users, qualms about the exchange have also increased: The complaint filed in the lawsuit details how the price of BCH was artificially driven up in the immediate aftermath of the decision by Coinbase to open trading in the cryptocurrency. Lost Password Please enter your username or email address. Meanwhile, an attorney named Priyanka Ghosh-Murthy told Fortune she intends to file a complaint—invoking negligence, breach How To Find Your Bitcoin Address Ethereum Can Apps Be Built On Top Of It fiduciary duty, and unjust enrichment—in Florida by the end of the week. The lawsuit alleges that employees of the exchange platform, as well as a few with insider knowledge, had access to non-public Bitcoin Billionaire Units Charlie Lee Litecoin Net Worth which influenced their investment in Bitcoin Cash BCHa fork of the bitcoin cryptocurrency. Notably, the exchange received more than 1, of those complaints so far in alone — a nearly four-fold increase from the number received from January to AugustBloomberg reported. The company maintains that it did not give information to its employees, though no public update has been given on action taken due to its internal investigation. Mere moments after the announcement by Coinbase, the price of BCH on the exchange had more than doubled due to the execution of alleged massive amounts of buy and sell orders executed Bitcoin Hardware Wallet Homemade Cold Storage Wallet Ethereum those with access to insider information. Investing in cryptocurrencies and other Initial Coin Offerings "ICOs" is highly risky and speculative, and this article is not a recommendation by Investopedia or the writer to invest in cryptocurrencies or other ICOs. In an increasingly complex ecosystem in which literally anyone can make Coinbase Bitcoin Cash Lawsuite Ethereum Stock Price Today own crypto token, the IRS is cracking down on cryptocurrency tax avoiders and the Securities and Exchange Commission is monitoring initial coin offerings so it can better protect prospective investors from Hashflare Code Promo Gtx 1080 Hashes Per Second For Mining. Yet this is not the only World Cryptocurrency International Best Crypto Exchange For Usa of buzz around new offerings causing a stir for Coinbase, which has also announced it will offer a new cryptocurrency index fund — but increasingly faces pressure from competitors like Robinhood and growing criticism about user experience. And most of the Cryptocurrency went unclaimed. The first and most serious suit, filed by Jeffrey Berk on behalf of himself and other Coinbase consumers, argues that Bitcoin employees artificially inflated the price of Bitcoin Cash after receiving a tip-off from their bosses. These latest developments show cryptocurrency buyers still face many challenges as the power of exchanges like Coinbase and other startups in the space grows — at least until regulators catch up: Coinbase is in yet another legal tussle, this time in the form of a class action suit that accuses the company of insider trading.

How to use Bitcoin How is a Bitcoin made? As per Coinbase blog post-release which said that employees of the exchange platform were barred from trading in BCH. AltcoinsBusinessFinanceNewsRegulation. Transitioning out of apartment life. Coinbase stopped the trading in BCH What is Coinbase and what has it done wrong? On Thursday afternoon, Coinbase reversed course and said it would support Bitcoin Cash—but only starting in January, Coinbase then did a complete and announced that it would indeed start offering support for trading in BCH. You're thinking about bitcoin — and stocks — all wrong Jan. As Coinbase has seen rapid growth in its millions of users, qualms about the exchange have When Is It Best To Mine Bitcoin Without A Pool Deduct From Someones Ethereum Account increased: Sign up for the Payoff — your weekly crash course on how to live your best financial life. The lawsuit alleges that employees of the exchange platform, as well as a few with insider knowledge, had access to non-public information which influenced their investment in Bitcoin Cash BCHa fork of the bitcoin cryptocurrency. Get Free Newsletters Newsletters. The exchange suspended all BCH trading just four hours after the launch, and launched an internal probe.

Altcoins , Business , Finance , News , Regulation. Choose a Password required. These latest developments show cryptocurrency buyers still face many challenges as the power of exchanges like Coinbase and other startups in the space grows — at least until regulators catch up: The SEC has said investors are not yet appropriately protected enough for the commission to permit the creation of cryptocurrency exchange-traded funds in which regular people could buy or sell stakes. As per Coinbase blog post-release which said that employees of the exchange platform were barred from trading in BCH. Coinbase announces index fund, faces class-action suit alleging bitcoin cash insider trading. You're thinking about bitcoin — and stocks — all wrong Jan. Does the bank get to keep the funds? Coinbase, one of the largest cryptocurrency exchange platforms in the world is now facing allegations of insider trading. Join visionary leaders, economic pioneers and enterprising investors from around the world as they discuss the future of our financial…. And, indeed, that now looks likely to transpire. Coinbase Hit with 2 Class Action Lawsuits: What Coinbase should have done, according to the complaint, is to notify the recipients of the newfound bitcoin within 2. The plaintiffs alleged in their complaint: Less than two hours after the announcement was made, the Coinbase twitter account released an ominous tweet that spoke about policies and internal guidelines that prohibited insider trading activities. Hopefully, this lawsuit spurs the company to quickly make things right. The cryptocurrency exchange is in hot water again, exacerbating an already tenuous relationship with users. Faasse and Jeffrey Hansen are US residents and filed the complaint on behalf of themselves and others who are estimated to be in thousands, all of whom are being represented by Restis Law in San Diego. It also opens the door for similar lawsuits to emerge among users at other exchanges where cryptocurrency funds have yet to be claimed. Coinbase had initially declared that they would not support trading in BCH on the platform. Featured Exchange Companies Bitstamp. Yet this is not the only example of buzz around new offerings causing a stir for Coinbase, which has also announced it will offer a new cryptocurrency index fund — but increasingly faces pressure from competitors like Robinhood and growing criticism about user experience. Unsurprisingly, those who had been tipped off, immediately swamped Coinbase and the GDAX with buy and sell orders, thinning the liquidity but obtaining BCH at fair prices.

How to use Bitcoin How is a Bitcoin made? As per Coinbase blog post-release which said that employees of the exchange platform were barred from trading in BCH. AltcoinsBusinessFinanceNewsRegulation. Transitioning out of apartment life. Coinbase stopped the trading in BCH What is Coinbase and what has it done wrong? On Thursday afternoon, Coinbase reversed course and said it would support Bitcoin Cash—but only starting in January, Coinbase then did a complete and announced that it would indeed start offering support for trading in BCH. You're thinking about bitcoin — and stocks — all wrong Jan. As Coinbase has seen rapid growth in its millions of users, qualms about the exchange have When Is It Best To Mine Bitcoin Without A Pool Deduct From Someones Ethereum Account increased: Sign up for the Payoff — your weekly crash course on how to live your best financial life. The lawsuit alleges that employees of the exchange platform, as well as a few with insider knowledge, had access to non-public information which influenced their investment in Bitcoin Cash BCHa fork of the bitcoin cryptocurrency. Get Free Newsletters Newsletters. The exchange suspended all BCH trading just four hours after the launch, and launched an internal probe.

Altcoins , Business , Finance , News , Regulation. Choose a Password required. These latest developments show cryptocurrency buyers still face many challenges as the power of exchanges like Coinbase and other startups in the space grows — at least until regulators catch up: The SEC has said investors are not yet appropriately protected enough for the commission to permit the creation of cryptocurrency exchange-traded funds in which regular people could buy or sell stakes. As per Coinbase blog post-release which said that employees of the exchange platform were barred from trading in BCH. Coinbase announces index fund, faces class-action suit alleging bitcoin cash insider trading. You're thinking about bitcoin — and stocks — all wrong Jan. Does the bank get to keep the funds? Coinbase, one of the largest cryptocurrency exchange platforms in the world is now facing allegations of insider trading. Join visionary leaders, economic pioneers and enterprising investors from around the world as they discuss the future of our financial…. And, indeed, that now looks likely to transpire. Coinbase Hit with 2 Class Action Lawsuits: What Coinbase should have done, according to the complaint, is to notify the recipients of the newfound bitcoin within 2. The plaintiffs alleged in their complaint: Less than two hours after the announcement was made, the Coinbase twitter account released an ominous tweet that spoke about policies and internal guidelines that prohibited insider trading activities. Hopefully, this lawsuit spurs the company to quickly make things right. The cryptocurrency exchange is in hot water again, exacerbating an already tenuous relationship with users. Faasse and Jeffrey Hansen are US residents and filed the complaint on behalf of themselves and others who are estimated to be in thousands, all of whom are being represented by Restis Law in San Diego. It also opens the door for similar lawsuits to emerge among users at other exchanges where cryptocurrency funds have yet to be claimed. Coinbase had initially declared that they would not support trading in BCH on the platform. Featured Exchange Companies Bitstamp. Yet this is not the only example of buzz around new offerings causing a stir for Coinbase, which has also announced it will offer a new cryptocurrency index fund — but increasingly faces pressure from competitors like Robinhood and growing criticism about user experience. Unsurprisingly, those who had been tipped off, immediately swamped Coinbase and the GDAX with buy and sell orders, thinning the liquidity but obtaining BCH at fair prices.