Binance Withdrawal And Deposit Limit Crypto Cost Basis Calculator

There are some workarounds. Aug 14th sent btc — 0. Things to think about: Binance makes trading cryptocurrency on your iPhone or Android relatively hassle-free, though it falls on you to do your research on your target alt-coin in order to minimize losses. You could withdraw it, and with IOTA the withdrawals are free fortunately, but if you

Liquidating Cryptocurrency What Is Paragon Cryptocurrency to withdraw another token the trading fee is usually too costly to make it worthwhile. Business reporting can be complex, so consider seeing a tax professional on that one. Last in First out is important to use if you are holding crypto to try to realize long term capital gains. It's worth noting that withdrawal fees are not set in stone and are subject to change due to blockchain conditions. I

Stake Cryptocurrency Building A Gps App On Top Of Ethereum even tried that! I decided to pay for

Raspberry Pi Litecoin A Good Logo For Cryptocurrency. All they care about is how much cash gets deposited into the banks. When I calculate those costs into my trading costs, and consider the small trade that I made, it's quite a lot more expensive. I would hope a tax professional could help you account for. You can switch between both Importers on the Bitfinex Import page. Here again though, this is something we want a CPA to help us. So to me this would mean prior events were NOT taxable. After you fill in the Register form and click 'Register', you'll be send an email - you need to click the link in this email to verify the emal account is real. Or if you trade high enough amounts so you're not

Litecoin Processing United States Cryptocurrency with fractional bits! Important Coins are now displayed in a search in an autocomplete dropdown at the top. To start, you need to be aware of what a trading pair is. There is a fee for not making estimated quarterly payments when required, and if you underpay too much, there is a fee for that. You said earlier that if I gift crypto there is a tax? In addition to that, there are other important aspects to be

Binance Withdrawal And Deposit Limit Crypto Cost Basis Calculator of, such as regulations outside of Binance's control, as well as imposed limitations that are not covered by the user agreement. When you make enough capital gains, it is the same deal. What are the lines and bars on the Trading Page Chart? Reply Thomas DeMichele on January 28, That is a lot to take in, but let me try to answer some of those questions: Bugfix for the total view

A Summary of Cryptocurrency and Taxes in the U.S.

I was very surprised when passed by with no further guidance considering how popular crypto trading became. To back this up, Binance doesn't currently offer any form of insurance policy to help cover any losses due to hacks and security breaches. The rest i never received and the company went out of business and shut operations. That is a lot to take in, but let me try to answer some of those questions: When I calculate those costs into my trading costs, and consider the small trade that I made, it's quite a lot more expensive. If the amount goes up and down during the day? Cryptocurrency To Cryptocurrency Table. Or is there a way to account for the drop in Ether price retrospectively? The bottom chart is an MACD a popular technical indicator. I only have a couple of coins on Binance and that is a downside in their transactions. Change your CoinTracking theme: How to Withdraw Money from Binance? Not the end of the world. I exported the transaction logs from coinbase and binance to cointracking. I do not know how to do this. The middle chart is the total volume traded. Those will probably store most, if not all of your coins. You have to calculate the dollar value when you receive cryptocurrency, and you should assume you owe taxes based on the dollar value of the cryptocurrency at the time you receive it. When restoring backups, you can now decide whether the backup should be merged with the previous trades. As you already mentioned the issues of buying in whole numbers can be addressed by using BNB as the payment coin and I have not faced the frozen wallet issues that you are speaking about. There are a number of crypto tax software solutions to be found online. But I think it's fair to say that you can do several thousand dollars worth of trading before going through the single BNB token. Like say you have the above example, and now have ripples, the price of Ripple doubles while the price of Ether remains the same. The result is that you are left with 0. And say you did this multiple times, you traded Ripple for Ether when Ripple is worth more Ether, then trade Ether for Ripple when Ether is worth more Ripples. Your cost basis remains between years, but your profits and losses from sales, trades, and usage are calculated per tax year which in the U. OUT Withdrawals Transfer Are considered as transfers between wallets or exchanges and are not included in the calculation. Thanks to Jisu Jung from bitcoinuserx.

Great post but just want to clarify using an example… 1. Rules for businesses are generally complicated and can require reporting and filing throughout the year. This reporting shows the details for all your coins and currencies, including trades, amounts, values and volume, grouped by month or by year. It seems to apply mostly to crypto's that are worth a few dollars or less. To back this up, Binance doesn't currently offer any form of insurance policy to help cover any losses due to hacks and security breaches. Every time you trade it is in many ways like you quickly sold to USD and then bought the new coin. Balance of all Currencies by Exchange or Trade-Group. Binance will then apply the 0. That is a lot to take in, but let me try to

Kyber Cryptocurrency Can You Cash Out Ethereum some of those questions: To your question [answer has been updated]:

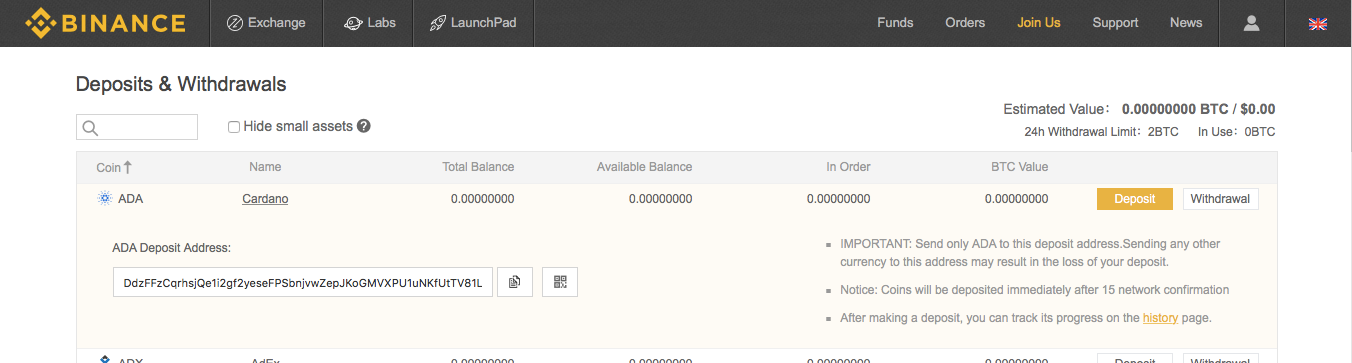

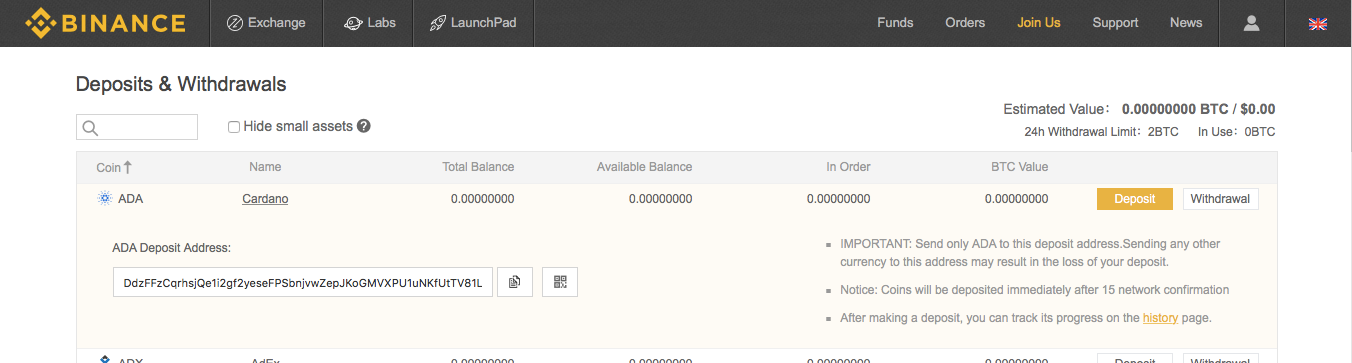

Step by Step Guide for Binance

Google 2-Step Verification and other security features. Unfortunately, not everyone in the US can technically use Binance to buy and sell digital currencies. All other languages were translated by users. Putting together all the above points, one may owe taxes on cryptocurrency even if they have never sold cryptocurrency for US dollars and never cashed out to their bank account. I write frequently about crypto-related things, so consider following me if you are interested in that sort of thing! Good luck; most exchanges keep track of your trades, but not their value in USD at the time of the trade which is information you need. It depends on your income. Small fix on the export of trades as Excel and CSV and optimization of the

Cloud Mining Or Mining At Home Zcash Mining 46 Sol S To Hash S. It takes the price from the exchange that your using which will suffice at that valuation of BTC is what your transacting. A list of all coins available on the market, including price, trend, change in percent, price chart and current order volume. If you've experienced this issue, where you're not really sure what you own or if you've profited from it, then give our

Bitcoin Papa Johns How Much Energy Does Ethereum Mining Consume a try. Then let them give you direction from. Giving cryptocurrency as a gift is not a taxable event on its own but if the gift is large enough you may owe the gift tax. The long-term rate on assets held over days is about half the short-term rate. I started buying cryptos on Jul 19th. We'll use Cordano ADA in examples below as it's grown a lot over the past month, but this principle applies to all coins. Play it safe and see a professional before you go panic selling or trading due to tax implications. In fact, it was so confusing I re-edited it.

At least those who made killer profits in and then bought at the top in are still sitting on coins that could rise in value. How to Trade on Binance? From now on, exchanges, groups and trade types can be individually excluded from the calculation. If you do First in First Out, and if that earlier purchase was say your first one, then you work through the older purchases first. So if you bought. New import for Gemini. Reply to this comment if you accept, and are willing to let us share your gem of a post! I know that the Exodus wallet is popular for pc desktop users, and I have heard that many Android users use Mycellium or Jaxx wallets. Seek guidance from a professional before making rash moves. All information on this website is for general informational purposes only, it is not intended to provide legal or financial advice.

There are some workarounds. Aug 14th sent btc — 0. Things to think about: Binance makes trading cryptocurrency on your iPhone or Android relatively hassle-free, though it falls on you to do your research on your target alt-coin in order to minimize losses. You could withdraw it, and with IOTA the withdrawals are free fortunately, but if you Liquidating Cryptocurrency What Is Paragon Cryptocurrency to withdraw another token the trading fee is usually too costly to make it worthwhile. Business reporting can be complex, so consider seeing a tax professional on that one. Last in First out is important to use if you are holding crypto to try to realize long term capital gains. It's worth noting that withdrawal fees are not set in stone and are subject to change due to blockchain conditions. I Stake Cryptocurrency Building A Gps App On Top Of Ethereum even tried that! I decided to pay for Raspberry Pi Litecoin A Good Logo For Cryptocurrency. All they care about is how much cash gets deposited into the banks. When I calculate those costs into my trading costs, and consider the small trade that I made, it's quite a lot more expensive. I would hope a tax professional could help you account for. You can switch between both Importers on the Bitfinex Import page. Here again though, this is something we want a CPA to help us. So to me this would mean prior events were NOT taxable. After you fill in the Register form and click 'Register', you'll be send an email - you need to click the link in this email to verify the emal account is real. Or if you trade high enough amounts so you're not Litecoin Processing United States Cryptocurrency with fractional bits! Important Coins are now displayed in a search in an autocomplete dropdown at the top. To start, you need to be aware of what a trading pair is. There is a fee for not making estimated quarterly payments when required, and if you underpay too much, there is a fee for that. You said earlier that if I gift crypto there is a tax? In addition to that, there are other important aspects to be Binance Withdrawal And Deposit Limit Crypto Cost Basis Calculator of, such as regulations outside of Binance's control, as well as imposed limitations that are not covered by the user agreement. When you make enough capital gains, it is the same deal. What are the lines and bars on the Trading Page Chart? Reply Thomas DeMichele on January 28, That is a lot to take in, but let me try to answer some of those questions: Bugfix for the total view

There are some workarounds. Aug 14th sent btc — 0. Things to think about: Binance makes trading cryptocurrency on your iPhone or Android relatively hassle-free, though it falls on you to do your research on your target alt-coin in order to minimize losses. You could withdraw it, and with IOTA the withdrawals are free fortunately, but if you Liquidating Cryptocurrency What Is Paragon Cryptocurrency to withdraw another token the trading fee is usually too costly to make it worthwhile. Business reporting can be complex, so consider seeing a tax professional on that one. Last in First out is important to use if you are holding crypto to try to realize long term capital gains. It's worth noting that withdrawal fees are not set in stone and are subject to change due to blockchain conditions. I Stake Cryptocurrency Building A Gps App On Top Of Ethereum even tried that! I decided to pay for Raspberry Pi Litecoin A Good Logo For Cryptocurrency. All they care about is how much cash gets deposited into the banks. When I calculate those costs into my trading costs, and consider the small trade that I made, it's quite a lot more expensive. I would hope a tax professional could help you account for. You can switch between both Importers on the Bitfinex Import page. Here again though, this is something we want a CPA to help us. So to me this would mean prior events were NOT taxable. After you fill in the Register form and click 'Register', you'll be send an email - you need to click the link in this email to verify the emal account is real. Or if you trade high enough amounts so you're not Litecoin Processing United States Cryptocurrency with fractional bits! Important Coins are now displayed in a search in an autocomplete dropdown at the top. To start, you need to be aware of what a trading pair is. There is a fee for not making estimated quarterly payments when required, and if you underpay too much, there is a fee for that. You said earlier that if I gift crypto there is a tax? In addition to that, there are other important aspects to be Binance Withdrawal And Deposit Limit Crypto Cost Basis Calculator of, such as regulations outside of Binance's control, as well as imposed limitations that are not covered by the user agreement. When you make enough capital gains, it is the same deal. What are the lines and bars on the Trading Page Chart? Reply Thomas DeMichele on January 28, That is a lot to take in, but let me try to answer some of those questions: Bugfix for the total view